Enabling Net Zero and protecting wealth – Will miners be a bright spot in 2023?

A turnaround may be underway for metals and miners, backed by global efforts to achieve net zero and by the fight to protect wealth against inflation.

Global financial markets were shaken by a range of troubling economic and geopolitical events during 2022. From the war in Ukraine and the ensuing energy crises, to rampant inflation globally in the wake of disrupted supply chains and economies’ reopening post-COVID-19, as well as the tightening of monetary conditions, investors face an environment of continuing uncertainty and risk at the start of 2023.

Amid a clouded outlook for the global economy, one sector offers a bright spot for investors. The metals and mining industry is backed by secular growth trends; most notably the historic levels of investment in green infrastructure and technology, as well as near-term thematic trends including supply chain reorganisation, inflation and geopolitics. The sector is further supported by the start of a macroeconomic shift as central bankers prepare to conclude interest rate hike cycles, as well as signs that the US dollar has peaked.

Mining companies are uniquely linked to the key themes facing investors in 2023, both as producers of the critical raw materials which enable green technology, and as a source of wealth protection at a time of economic upheaval. As one of the few equity sectors which offers value and growth at present, we consider there are a range of core drivers for the metals and mining sector at the start of 2023:

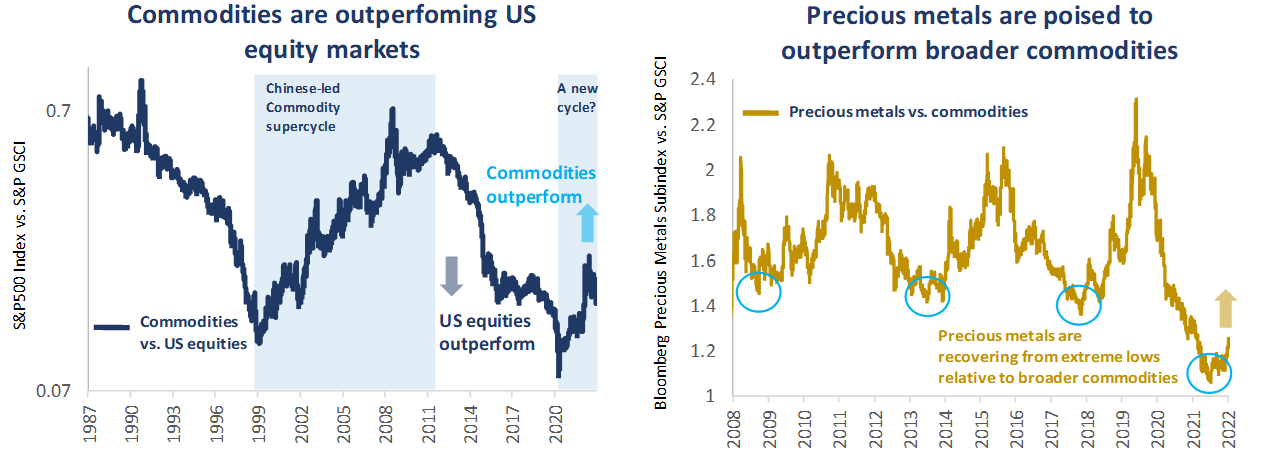

- The cycle is turning – Commodities are starting to outperform broader financial assets, amid persistent inflation, confrontational geopolitics, and supply chain reorganisation.

- No net zero without mining – A range of metals form the critical building blocks for green technology. With governments globally committed to Net Zero, surging demand stands to transform the mining industry.

- A new macroeconomic phase – The headwinds for precious metals are fading as the US interest rate hike cycle runs its course and inflation appears likely to remain significantly above the US Fed’s 2% target.

- Miners offer value and growth – Mining companies appear undervalued on a fundamental and historical basis, yet the sector offers strong margins and shareholder returns, while ESG performance has improved markedly.

After a volatile year for commodities markets in 2022, the sector now finds itself amid a turnaround and potentially at the start of a significant period of outperformance relative to broader financial assets. While we expect uncertainty to persist in 2023, as active investment managers we position our strategies to thrive under these conditions, allocating to those sub-sectors of the mining sector which stand to benefit from both secular and tactical growth trends.

Figure 1

Data as at 12 December 2022. Source: Bloomberg, Baker Steel Capital Managers LLP.

No net zero without mining – Can the West get the strategic supplies it needs?

The clean energy transition, a historic undertaking across governments, businesses and citizens, is undoubtedly the largest secular demand trend for metals in the decade ahead. As global industries transition away from fossil fuels towards cleaner sources of energy, the mining industry stands to be transformed by surging demand and supply chain restructuring. The implications are particularly significant for those critical materials needed to expand renewable energy sources, develop battery technology and build green infrastructure. The markets for these metals are typically far smaller than for bulk commodities and forecasts indicate unprecedented demand.

Despite economic and political turmoil in 2022 and temporary increases in fossil fuel production, governments globally have remained committed to achieving Net Zero in the coming decades. Commitments were reaffirmed at the recent COP27 conference, while the Biden Administration increasingly supports the development of green industries in the US, most notably through the Inflation Reduction Act, with the central aims of CO2 emissions reduction, investment in domestic energy production and the promotion of clean energy. Overall, momentum continues to build for the green revolution and as investors we remain exposed to those sub-sectors of the mining industry best positioned to benefit from this secular growth trend in the years to come.

In addition to this long-term supportive trend, we identify a range of near-term themes for speciality metals miners at the start of 2023. Supply chain reorganisation amid global shortages of raw materials, China’s re-opening after lengthy COVID-19 restrictions, and rising geopolitical tension, are all factors which indicate competition for supplies of strategic commodities will be a dominant theme for the year ahead.

The COVID-19 pandemic highlighted the fragility of supply chains, and economic re-opening around the world has led to rising commodity prices, inflation, and in many cases a reorganisation of supply chains to protect domestic industries. Yet the most significant re-opening, China, has only just begun, following the relaxation of its Zero-COVID policy. China’s re-opening will likely boost demand for raw materials, although questions remain regarding the economic consequences of high COVID-related fatalities and pressure on the country’s health system.

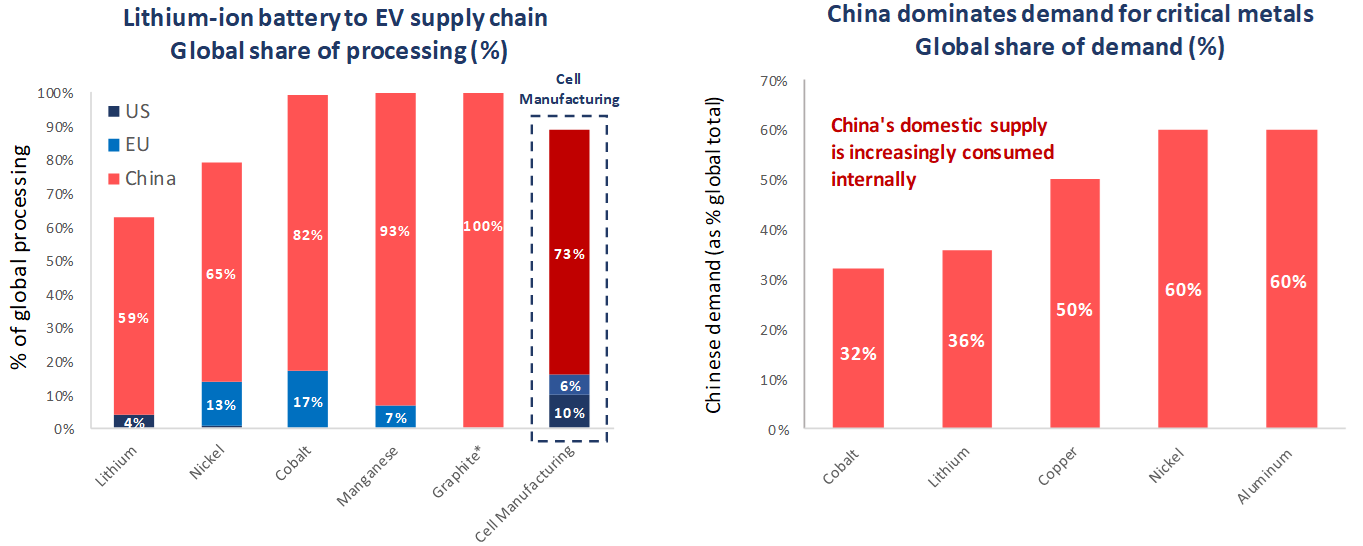

Figure 2

Note, based on 2019 demand, processing and manufacturing totals. *Flake graphite feedstock, all anode natural and synthetic. Source: Benchmark Mineral Intelligence, USGS, Baker Steel Capital Managers LLP

As the charts above illustrate, China dominates the supply chain for speciality and battery metals, particularly those needed to produce lithium-ion batteries, notably lithium, nickel, cobalt and graphite, along with copper and aluminium, which are both vital metals for electrification. While speciality metals mining itself is more geographically diverse, determined by geology and the economic viability of deposits, the processing of chemicals and metals for use in lithium-ion battery technology is overwhelmingly concentrated in China.

Production of lithium-ion batteries is among the most significant challenges for US and European electric vehicle (“EV”) manufacturers, and supply chain risks will increase as the Chinese economy reopens. China accounts for around 73% of cell manufacturing for lithium-ion batteries, dwarfing the US and Europe which account for 10% and 6% respectively. As the largest consumer of speciality metals, China is increasingly consuming its domestic supply internally; and this trend appears likely to continue amid supply side reforms. Chinese companies have also heavily invested in mining operations globally, further internalising the supply chain for Chinese manufacturers.

This concentration of processing and production in China is a substantial challenge for Western governments and industries, which seek a path to Net Zero and energy security. Efforts to bolster the West’s supplies of critical materials over the past decade have produced limited results, yet under the Biden administration efforts to strengthen US supply chains have continued to increase. In addition to the Inflation Reduction Act, the “REEShore Act”, aims to increase the production and storage of rare earths in the US, while restricting the use of Chinese-made rare earth products in military technologies.

Aside from China, the geopolitical landscape changed significantly during 2022, causing further risks to supply chains to arise. Most notably, Russia’s invasion of Ukraine has exacerbated concerns over supplies of strategic raw materials, as Western countries and businesses face uncertainty over supply, ranging from energy supplies to Europe, to agricultural goods and speciality metals for hi-tech industry. Meanwhile countries under or at risk of sanctions by the US and its allies, seek to protect their own supply chains through re-routing, often away from Europe. The expansion of direct trade routes between Russia, China and much of Central Asia does not yet constitute an axis in opposition to the West, yet it does demonstrate that the shared economic and political interests of these countries are driving a shift towards multi-polar geopolitics.

Taking these factors into account, we believe the speciality metals sector has never been more relevant to investors as it is at the start of 2023. CAPEX for developing new supplies of critical metals has so far failed to match the scale of the transition which is needed to achieve Net Zero and energy security for the West. Supply chain challenges and volatile geopolitics indicate higher prices ahead, potentially with periodic price spikes, for speciality metals. We consider that commodity markets will likely continue to outperform global equity markets in 2023, while mining equities stand to undergo a re-rating of share prices as margins expand and investors build positions in real assets and thematic equities exposed to the green revolution and clean energy transition.

As macroeconomic headwinds fade, is it time for precious metals to shine?

2022 was a year of two distinct phases for gold and silver, both driven by the interplay between inflation, interest rates, and rising geopolitical risk. After gold revisited its all-time highs at the start of the year, prompted by safe-haven demand following Russia’s invasion of Ukraine, the metal faced a sharp sell-off during the second quarter caused by a combination of US rate hikes and a surging US dollar. This period saw the gold price erase much of its recent gains by mid-2022, yet the autumn and winter months saw precious metals sector stage a strong recovery, driven by signs that the US rate hike cycle is nearing completion, inflation is tempering (yet remains high) and the US dollar has peaked.

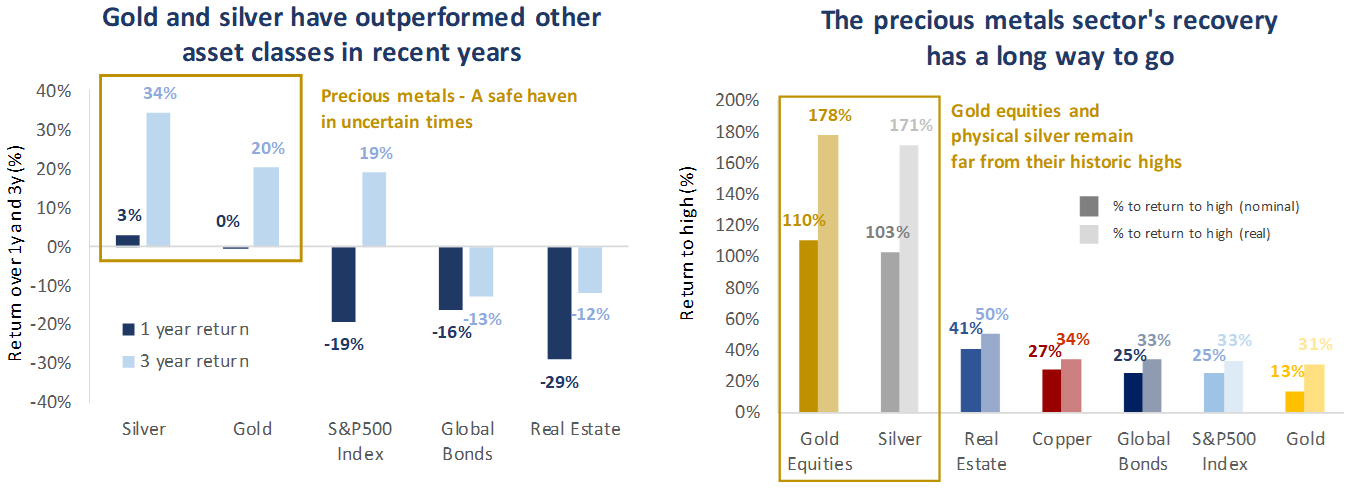

Overall, we consider that the most significant driver for gold and silver remains real US interest rates. Given that 2022 saw the steepest US interest rate hiking programme in recent history, bringing borrowing costs to levels not seen for 13 years, gold’s performance was quite encouraging, ending the year roughly flat, compared to many other major asset classes which saw heavy losses during the year.

Figure 3

Source: Bloomberg, Baker Steel Capital Managers LLP. Notes, Real Estate is based on the Bloomberg US REITs, Global Bonds are based on the Bloomberg Global Aggregate Bond Index, Gold Equities are based on the EMIX Global Mining Index. “% return to high (real)” is based on US CPI index. Data at 30 December 2022. All data in USD terms.

With the headwinds of rising US rates and US dollar strength now fading, we believe the precious metals sector is now at a turning point amid a range of catalysts for recovery in 2023. Central bankers, led by the US Fed, which stuck to their conviction on rate hikes during 2022, now face the threat of slowing economic growth and possible deep recession as tighter monetary conditions bite in the real economy. A dovish shift by central banks seems a strong possibility in the year ahead, as policymakers re-focus on growth.

Yet inflation is far from vanquished. We consider that inflation rates will remain elevated for a protracted period, given many of the core drivers of higher prices have not dissipated. The persistently tight labour market, particularly in the US, will continue to drive wage pressure, while higher borrowing costs will keep the pressure on businesses to raise prices to protect margins. Furthermore, as discussed in the previous section, the redrawing of supply chains, including onshoring and reshoring, alongside strategic competition, are inherently inflationary. All of these factors, compounded by the ongoing impact of geopolitical turbulence on energy and commodity prices, indicate inflation will prove resilient, remaining above central bankers’ targets for some time. With interest rates already raised sharply and balance sheet reduction underway, the US Fed and other major central banks have limited tools to bring inflation back to 2% without risking a lengthy, deep recession. Should nominal rates be cut in 2023 in an effort to support flagging growth, while inflation remains high, precious metals will face supportive economic conditions as real interest rates decline.

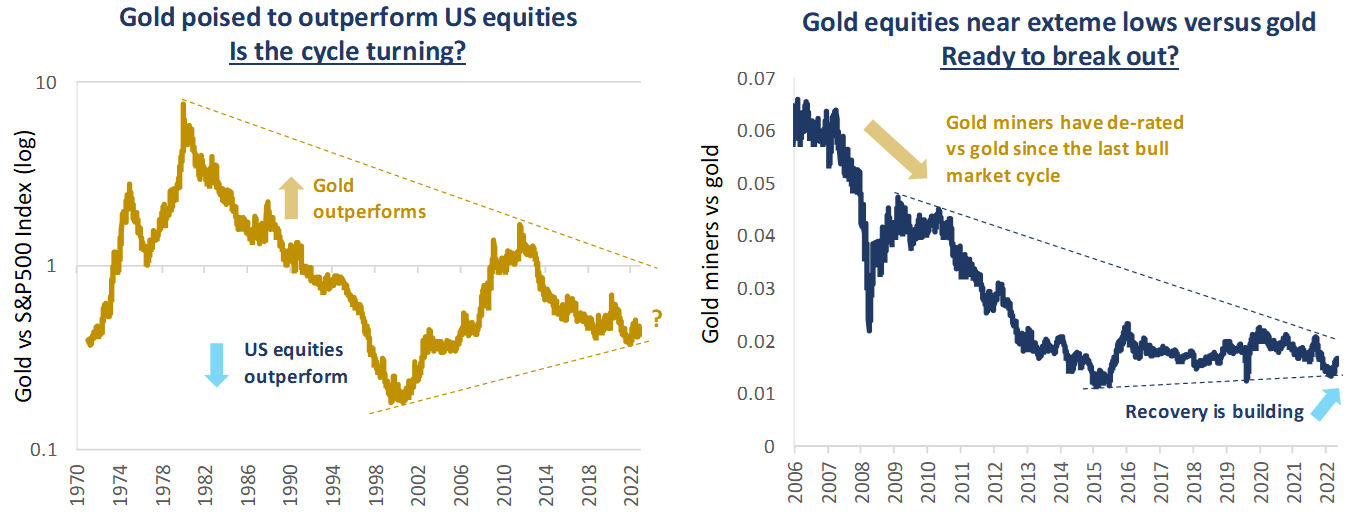

Looking at the longer-term trends for gold and gold equities on the charts below, we consider the catalysts mentioned above may mark the start of a significant upcycle. Gold appears poised to build on its recent outperformance of general equity markets, while gold equities, which de-rated versus gold for much of the last decade, are positioned for a period of outperformance against the physical metal.

Figure 4

Data as at 30 December 2022. Source: Bloomberg, Baker Steel Capital Managers LLP.

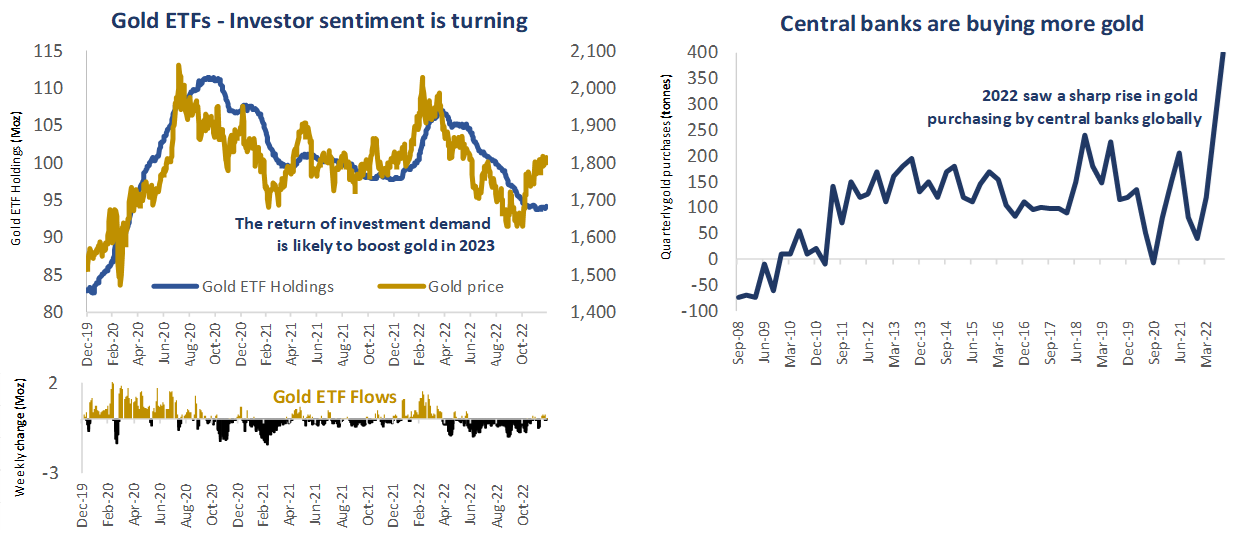

Alongside the supportive macroeconomic and technical picture for gold, we are also seeing a shift in fundamental supply and demand dynamics for the physical metal. Firstly, a marked shift in investor sentiment is underway, illustrated by gold ETF flows which, having been negative for most of 2022, are now showing small net inflows. Investment demand is a core driver of gold price rallies and as sentiment continues to improve, we expect flows into gold products to push prices higher in the near term. Secondly, we are seeing a major shift in central banks’ demand for physical gold. 2022 saw a historic rush by many central banks to increase their gold reserves, with c.400 tonnes purchased during the third quarter of 2022, bringing the annual total to the highest level since 1967.

A combination of factors is driving central banks to increase their gold reserves, notably gold’s well-documented role as an effective portfolio diversifier during times of heightened economic and geopolitical risk. Alongside this well-established rationale, a further reason for rising central bank purchases appears to be diversification of currency reserves, particularly with regard to US dollar exposure. The events of 2022 have highlighted the benefits of physical gold as a decentralised monetary asset, which cannot be restricted or manipulated. We anticipate that the trend of strong physical demand will continue to buoy the gold market in 2023.

Figure 5

Source: Bloomberg, Metals Focus, Refinitiv GFMS, World Gold Council. Data as at 28 December 2022.

Overall, 2022 may have been an underwhelming year for the precious metals sector, yet we believe the scene is set for a strong recovery period, during which gold will progress towards new highs and precious metals miners will undergo a re-rating of share prices relative to gold. We consider that silver and silver miners present a particular opportunity at present, given the supportive fundamentals for silver as both a precious metal, which has historically tended to outperform gold during a bull market, and as a key industrial metal for the green revolution, with application across green technology, most notably in solar photovoltaic cells.

Will undervalued miners prove a bright spot for investors in 2023?

With a strong outlook for commodities in 2023, particularly for precious and speciality metals, the year ahead holds significant promise for mining equities. With regard to the companies themselves, the mining sector is generally in good health, following a period of capital discipline since the last bull-market which ended a little over a decade ago. Margins have remained strong and shareholder returns have increased in recent years. This places miners in a strong position to benefit from the increasingly positive fundamentals for the commodities they produce, as well as from improving investor sentiment towards hard assets. Many companies are also demonstrating sustainable and organic production, driven by successful exploration investment, while miners’ ESG performance (a central factor in Baker Steel’s investment process) continues to improve significantly.

Cost inflation remains an issue for the mining sector. Operating cost inflation impacts all miners, yet quality companies are offsetting this with continuous improvements. Capital cost inflation, on the other hand, is an issue for those companies that need to build new projects. As a result, cost inflation impacts companies in markedly different ways, allowing active managers to focus on those miners best placed to manage inflation.

The cycle appears to be turning for miners, both in terms of secular growth trends gaining pace and improving short-term macroeconomic conditions for commodity prices. A rotation by generalist investors towards seeking value may further benefit miners, which despite recent strong performance, still appear dramatically undervalued on a fundamental and relative basis. Many mining companies are far from their price highs, even before considering the impact of inflation. With the mining sector in a stronger position that it has been for decades and with a range of near-term catalysts in place for commodity markets, we are encouraged to see a positive outlook for the metals and mining sector in 2023.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.