Global markets at an inflection point – The new commodity supercycle is just getting started

Inflation, energy crises and tense geopolitics signal a strong outlook for miners.

Global financial markets face an inflection point amid the aftermath of COVID-19, the Russia-Ukraine conflict, the rise of a bi-polar geopolitical world, deglobalisation, and with the fight against climate change at a critical juncture. Under these conditions commodities markets and the mining sector have come into sharp focus for investors, with deficits forecast for certain critical raw materials, rampant inflation and growing concerns over energy security.

Alongside these current themes, longer-term secular trends promise to transform the mining sector in the years ahead. The ‘green revolution’ will boost demand for speciality metals, while monetary imbalances, most notably unprecedented expansion of money supply and debt in response to the COVID-19 pandemic, indicates that a re-rating of real assets is due. With both short-term and long-term drivers in place for natural resources, we see two key themes for investors in today’s turbulent market environment:

- Commodities have a strong outlook relative to other asset classes – Regardless of current global uncertainty, demand for raw materials is rising. BAKERSTEEL Electrum Fund offers exposure to the ‘future facing’ sub-sectors of the mining sector.

- Gold has typically been a prudent investment during historical inflection points – Gold acts as a safe haven investment and portfolio diversifier, while gold miners appear undervalued and in strong shape. BAKERSTEEL Precious Metals Fund targets high-quality, dividend paying gold and silver producers.

Inflation is already boosting certain commodity prices. Which will be next?

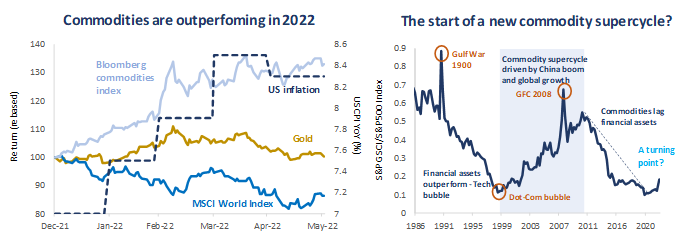

The new era of inflation is underway, with consumers and businesses facing higher costs and governments fighting inflationary challenges not seen in developed markets for decades. Historically, commodity prices have thrived under such conditions and the same appears true of today. Commodities have outperformed equities during 2022, so far, supporting the case that they are an effective hedge against inflation.

Figure 1

Source: Bloomberg. Data at 1 June 2022. Data in USD terms.

Food and energy prices have led the way so far, with fertilizer up +67% over the past twelve months, food prices up +26% (CRB Food Index), natural gas up +167% and oil up +81% (source: Bloomberg, as at 31 May 2022). Battery metals have also made strong gains, with nickel up +57%, cobalt up +69% and lithium up a remarkable +392% over the same period. In contrast precious metals have yet to display the price gains one might expect under such inflationary conditions. Inflation has proved stronger and more persistent than policymakers expected, and central bankers now find themselves playing catch-up through hawkish rhetoric and accelerated rate hike projections to try to tame price rises. The resulting surge in US yields has been a headwind for precious metals, which are sensitive to rising real rates.

Yet history suggests a period of outperformance for precious metals lies ahead, alongside many other commodities. Putin’s invasion of Ukraine has unleashed further inflation, impacting supply chains which were already under strain from the COVID-19 pandemic and from ongoing structural changes such as reshoring, economic nationalism and demographic change. Inflationary pressure has been building for years, as money printing, historic stimulus and financial repression caused monetary imbalances to grow. We believe this fundamental shift in geopolitics and global financial markets marks a turning point for commodity markets. Inflation has sparked commodity price rises, however it is the longer-term demand and supply dynamics which will drive the new upcycle for commodities and miners.

Commodity super-cycles are largely driven by two factors: increasing CAPEX and demographic change. During the Chinese-led super-cycle of the late 1990s and 2000s, around USD 15 trillion (inflation adjusted) was spent on development and infrastructure, while around half-a-billion people were taken out of poverty. The new commodity super-cycle is also driven by these two factors, underpinned by CAPEX spending and demographic shifts, however with some notable differences. It is estimated that around USD 15 trillion will be required in the next decade to achieve net zero, an amount reminiscent of the CAPEX spent during the last super-cycle, followed by another USD 30 trillion the decade after. These are staggering numbers which will certainly be positive for commodity markets, yet the focus of the spending will be markedly different from the last super-cycle. This time it is electric vehicle (“EV”) plants, grid batteries and solar panels which will be built, rather than roads, bridges and apartment buildings. Likewise, demographic developments are supportive of higher commodity prices, particularly as populations age, with incomes boosted by government stimulus. Political support for reshoring of supply chains, energy security and economic nationalism appear likely to remain, promising to boost sub-sectors of the commodities and favouring producers which can operate securely, supplying strategic metals and materials, while managing costs.

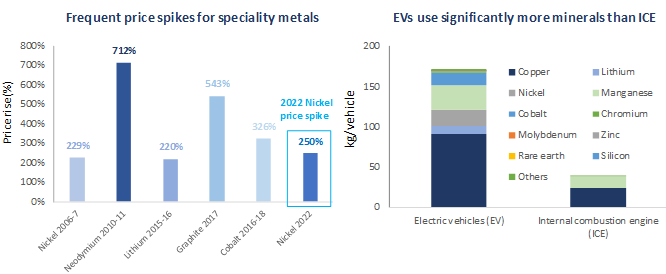

The pace of change underway for the metals and mining sector is highlighted by the rapid development of the EV industry, and in the mix of metals required for the sector’s growth in the years ahead. EV sales account for a rising proportion of global car sales (7.2% in 2021), EV production is rising faster than anticipated, while lithium-ion batteries prices are becoming increasingly competitive. With major car manufacturers having committed to 100% zero emissions for new car sales over the next two decades, we expect rapid production increases to continue alongside significant infrastructure development.

Figure 2

Source: Bloomberg, Baker Steel Capital Managers LLP, Mark Mills – “An Energy Transition vs. A Great Energy Reset?

The beneficiaries of the green revolution and energy transition include a wide range of metals and materials. Some are well known, such as lithium, cobalt and nickel, which are richly used at differing weightings in lithium-ion batteries required for EVs and energy storage. Other metals such as copper, needed in vast quantities for circuitry, and silver, which has diverse industrial applications, most notably in the production of photovoltaic cells used in solar power, similarly face a strong demand outlook. Others are lesser-known, such as magnesium, molybdenum and vanadium are used to produce strong lightweight frames, alongside rare earths for use in generators and motors, and graphite, a key battery material. Outside of the EV sector, the development of broader green technology requires a wide range of materials. Wind and hydro power utilise zinc, titanium and manganese, alongside the core ‘green’ industrial metals copper and nickel. Grid storage development, a critical part of green infrastructure, requires a range of battery and industrial metals. You can read our team’s commodity focus pieces here.

As demand rises, the potential for price spikes grows, particularly among some of the more esoteric metals which may face tight supply chains and geographical concentration. The recent c.250% spike in nickel prices, the result of a short squeeze on the LME sparked by concerns over the loss of Russian nickel, highlighted the potential fragility of certain commodity markets and sensitivity to geopolitical events. We believe producers of these critical materials present an exceptional opportunity for investors to benefit from the green transformation underway in the natural resources sector. As active managers, through our Electrum Fund we aim to offer exposure to producers of the critical “future facing” metals and materials required for green technology, decarbonisation and energy security. As we will address later in this report, miners remain undervalued and are in strong shape, and we believe this is one of the few equity sectors offering value, dividends and selective growth.

As commodities enter an upcycle, will the precious metals sector start to outperform?

Following strong performance during the onset of the COVID-19 pandemic in 2020, gold, silver and precious metals producers have since lagged broader commodities and general equity markets. The lack of momentum in the sector may seem surprising, given the rising inflationary forces, high debt levels and heightened geopolitical risk seen over the past year. It has become clear that in recent months investors’ fears over rising interest rates have outweighed concerns about persistent elevated inflation. Yet, with signs the headwinds for the sector will ease in the months ahead, the potential catalysts for recovery and outperformance by gold and silver can now be seen.

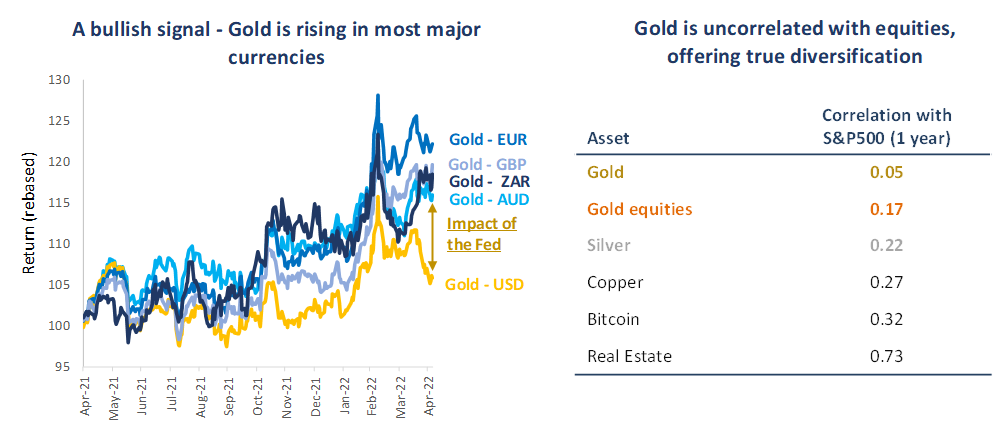

Gold is distinctly different from most other commodities, and prices can be driven by a diverse range of factors beyond simply supply and demand. Gold is a financial asset, but it is also the ultimate real asset, fulfilling multiple roles for investors, from acting as a portfolio diversifier retaining its value over time, to offering a safe haven during times of crisis, all the while remaining a luxury good, facing rising demand from the wealth effect. This highlights the metal’s relevance today, as investors face heightened economic and geopolitical risk and uncertainty, alongside high debt levels and persistent inflationary pressure. Amid rising demand for real assets and diversification, gold is well-positioned for a period of outperformance versus general equities. Gold’s recent performance highlights its portfolio diversification benefits, as an asset largely uncorrelated with broader financial markets.

Figure 3

Source: Bloomberg, Baker Steel internal. Data at 31 May 2022. Gold equities are represented by the EMIX Global Mining Gold Index.

There are signs that gold and silver’s period of consolidation may be nearing its end, and that the next upcycle for these metals may be approaching. Even to regain its 2020 highs, gold would have to rise +11.4%, while gold miners (GDX) would need to rise +40.3%. One notable bullish indicator can be seen in the performance of gold equities, which typically offer operational leverage to higher gold prices, and are already showing signs of outperforming physical gold during 2022 so far.

The headwinds which have dogged gold since these highs are likely to continue to fade. It is now widely accepted that inflationary pressure is not transitory and, while inflation may begin to ease as interest rates go up, price rises appear likely to remain well-above the levels of recent decades and well-above interest rates for some time. Recent US dollar strength has also weighed on gold’s performance, despite strong gains by the metal in other major currencies. Yet with the dollar having hit an almost 20 year high (DXY index) during May 2022, amid hawkish rate projections by the US Fed and a rush to cash in the face of turbulent financial markets, further upside for the greenback seems limited. In the short term, a weakening of the dollar would be supportive of a gold price recovery, while longer-term we consider the outlook for the dollar as a global reserve currency may be shifting, particularly should the move towards a bi-polar world continue, incentivising policymakers around the world to diversify their currency reserves.

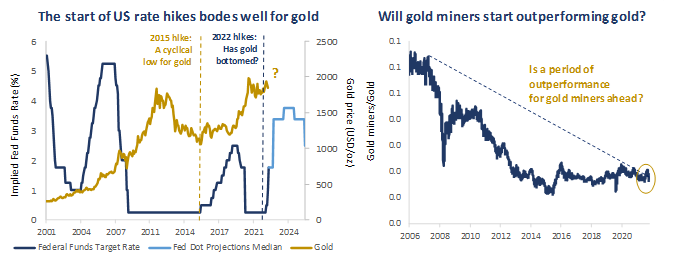

Figure 4

Source: Baker Steel internal, US Federal Reserve, Bloomberg. Data at 16 June 2022.

The most significant factor for gold, however, lies in the interplay between US inflation and interest rates. Gold has historically been an effective inflation hedge, yet it is typically negatively impacted by rising yields. Ultimately, it is real interest rates, rather than nominal rates, which are key for gold. Rate hike programmes are now underway around the world, with the US Fed leading the way with its hawkish positioning. While the pricing-in of a steep hiking cycle has restrained the gold price this year, despite surging inflation, it has also created an opportunity for investors.

Ultimately the Fed has limited policy tools to control inflation, as sharply higher interest rates threaten to damage growth and increase the debt burden on businesses, consumers, and public bodies. Higher prices appear here to stay, yet as US rate hikes begin to weigh on growth and employment, which has held up well so far, any resulting dovish shift and deceleration of the hiking cycle will prove a potent catalyst for the gold price to move higher. With the hawkish case for US rates already seemingly priced in, any undershoot of the Fed’s projections would be positive for gold. Notably, during the last rate hike cycle which began in 2015, the bottom of the market for gold was reached once hikes were underway and the Fed began to reposition its projections towards a more dovish stance. We feel it will be only a short time before this point is reached again, marking the start of the next upcycle for the precious metals sector.

Mining equities offer value, growth and returns – But can miners manage cost inflation?

With the new bull market already underway for many commodities, and others poised to rebound, the outlook for mining equities is more positive than it has been for many years. Miners remain undervalued on a historical and relative basis, yet the sector is performing better than it has done for decades. As margins expand and profitability rises, we expect many miners to benefit from a re-rating by the market.

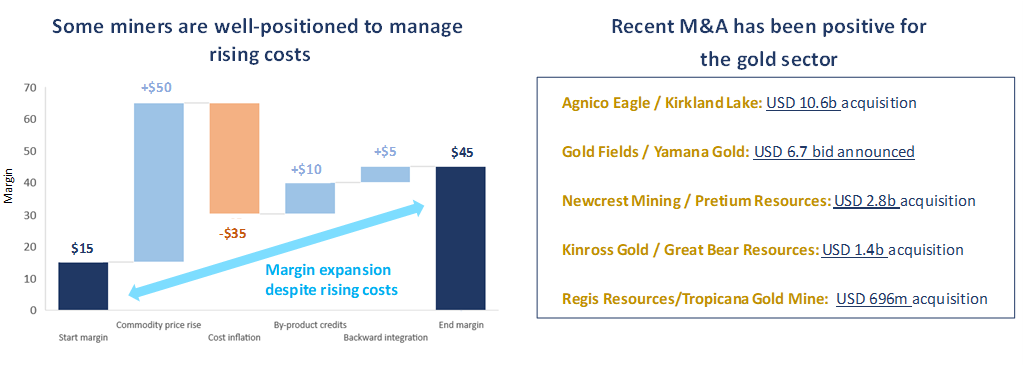

Yet miners face a substantial risk at present, cost inflation, driven by the broader inflationary pressure which we have discussed in this report. Inflation tends to boost commodity prices, but it also drives up the cost of labour and materials for miners, risking margin erosion even as metals’ prices rise. Our investment team meets frequently with management teams from across the mining sector and conducts site visits to key assets, as a core part of our bottom-up investment research. We have seen the impact of cost inflation on some companies, particularly for those with large CAPEX spending plans such as building large new projects. We estimate CAPEX inflation could be as high as 35% for some companies, compounded by logistical and supply chain issues. Meanwhile, while the dynamic environment makes forecasting difficult, we project that operating cost inflation running at 10% at least, driven largely by labour, energy and steel. Companies best placed to protect and expand margins are those which have, firstly, a robust ore body with a higher grade makes a project less sensitive to input costs, and secondly those with integrated energy source or long-term power supply agreements. By-product credits are also important.

In our view, miners need to focus on portfolio management, divesting non-core short life assets to concentrate on key assets. A few companies stand out in this regard, and we have built exposure to these through our funds, while others have struggled to rationalise their portfolios. Despite the risk posed by rising costs, we are encouraged to identify a selection of companies which are positioned to thrive under such conditions. At a high level, we have observed that most mid- to large-cap miners are maintaining capital discipline in the face of inflationary pressure, while effective management teams have been able to offset rising operating costs to date. European miners are in particularly strong shape, with good margins and free cash flow yield. Many European miners benefit from significantly lower cost inflation due to backwardation in energy, long-term contracts and exposure to renewable energy and by-product credits. Overall, higher energy costs are both a risk for miners and an opportunity for certain producers, as energy costs make up a sizable portion of total production costs for many metals. Aluminium producers illustrate this opportunity, as energy makes up around 60% of the metal’s cost base. As rising energy costs push up the price of aluminium, producers with fully integrated energy supplies can benefit from margin expansion.

Figure 5

Source: S&P Global Market Intelligence, Baker Steel Capital Managers LLP. Data at 31 May 2022.

Across the mining sector we see signs that companies are in good health, despite mixed investor sentiment in recent years. Sustainable and growing organic production is being demonstrated by the leaders in the sector, driven by successful exploration investment, in contrast to lower quality companies which face problems of reserve replacement. Selective, value accretive M&A is continuing, notably in the precious metals sector. Gold Fields’ recent bid for Yamana Gold, announced during May, with a value of c.USD 6.7 billion, has been the latest example of worthwhile consolidation over the past year involving several gold majors and Tier 1 assets.

Shareholder returns are increasing through dividends and buybacks, and we see the potential for this trend to continue as margins remain strong. Gold miners stand out in this regard, given precious metals producers have not historically paid strong dividends. Yet the EMIX Global Mining Gold Index has a forecast dividend yield of 2.0% for 2022, compared with the NASDAQ Index on 0.9% and the S&P500 Index on 1.7%, highlighting the relative strength of the gold sector’s shareholder returns potential. As active managers Baker Steel is focused on companies with favourable shareholder returns policies. At the time of writing, we estimate a 2.2% forecast yield for the holdings in the portfolio of the BAKERSTEEL Precious Metals Fund and 3.0% for the BAKERSTEEL Electrum Fund.

An increased focus on ESG topics by mining companies has continued. Baker Steel’s team engages with companies across our investment universe on ESG topics, and we consider that most companies are making progress, and many are planning significant investments in this area. Areas of focus for our team have been greenhouse gas emissions, community relationships, whistleblowing, and workplace culture. It remains our firm belief that companies which can demonstrate a high level of ESG performance, also tend to do well in other areas of management, operations, and risk-mitigation, to the benefit of stakeholders.

The stage is set for the new commodity super-cycle

With global financial markets at an inflection point amid rising economic and geopolitical risk, commodity markets have rarely been more relevant. Amid rising prices, tight supply chains, and soaring demand projections for critical metals from green industries, we believe we are seeing the early stages of the new commodity super-cycle, which will be led by the metals and materials required for the green revolution. We see a wide range of opportunities to participate in this long-term upcycle through producers of battery metals, such as lithium, cobalt, nickel and graphite, alongside certain industrial metals, notably copper.

The positive outlook for the precious metals sector remains a key theme for investors in the natural resources sector, being amongst the most undervalued sub-sectors of the mining industry. Gold and silver are well-supported as real assets, safe havens, portfolio diversifiers and, in silver’s case, a green industrial metal. We see a range of macroeconomic catalysts which will drive the sector’s recovery in the months ahead, as central banks shift their focus towards avoiding the economic slumps which appear likely as a result of preceding swift anti-inflationary interest rate hikes.

As an active investment manager and natural resources specialist, our objective is to offer our clients exposure to the major global themes which we have covered in this report. Through bottom-up research, a focus on value, risk management and ESG engagement, we intend for our funds to offer superior risk-adjusted returns and higher upside potential, relative to passive investments in the metals and mining sector via direct commodity exposure or ETFs.

Sources: Baker Steel Capital Managers LLP, Goldman Sachs: 2021 Sustainability Report, S&P Global Market Intelligence, US Federal Reserve.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.