Vital elements for Net Zero – Can miners meet soaring demand forecasts for critical metals?

Miners are in focus as industry and governments navigate supply constraints and geopolitical headwinds to secure the minerals needed for a sustainable future.

As the scale of the clean energy transition becomes increasingly clear across industry, media and political discourse, so does its transformational impact on the natural resources sector. Ambitious net zero goals set across the G7 and beyond are the driving force for decarbonisation, fuelling rapid development of green technology. Yet the challenges of supplying the raw materials needed for this growth have become stark, both in terms of the significant sums of investment needed to expand production and the urgent need to ensure security of supply chains in the face of rising geopolitical rivalry between the US, China and Europe, and their respective aligned interests.

Technological development, particularly in the areas of energy storage and electric vehicles (“EVs”), has progressed at a historic pace in recent years, surpassing industry expectations and even eclipsing the Baker Steel team’s optimistic outlook. The rapid expansion of green technology and the resulting surge in demand forecasts for metals remains the core investment rationale behind our Electrum strategy, which launched almost four and half years ago. Competition for supplies of critical materials will dominate the sector in the years ahead and, ultimately, efforts to achieve net zero will transform the metals and mining industry, both in terms of what is mined and how it is mined.

- The mining sector lies at the centre of the clean energy transition, amid broader ESG goals.

- Investment in the mining sector remains far below the levels needed to meet demand expectations. Many commodity prices will need to be higher for longer to incentivise the necessary growth.

- Miners appear undervalued and are in strong financial shape, while constructive M&A activity is rising.

- Investors in mining equities stand to benefit from this vast potential. Taking advantage of this opportunity, however, will require navigating a range of ESG, technology and supply chain risks.

Shortages of raw materials and rising risks to global supply chains have become recurring themes across an array of industries, from the construction, automotive and food sectors, to high-tech industries such as semiconductor production. Nowhere are these shortages of critical materials felt more acutely than in fast growing green technologies, where surging demand for renewable energy capacity, battery technology, and electronic components, are causing demand forecasts for critical metals to soar.

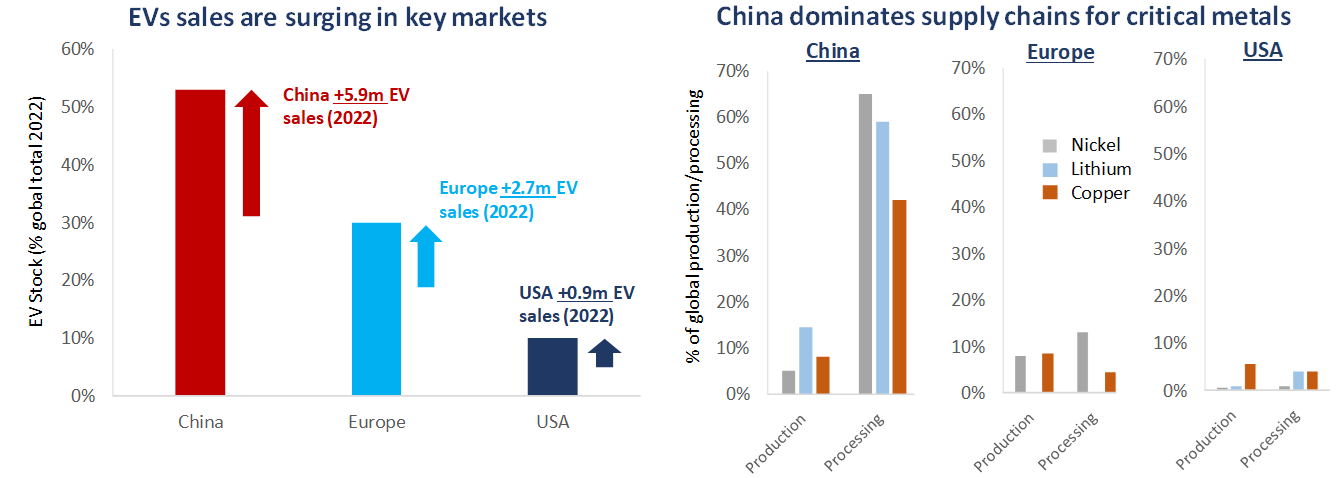

Figure 1

Source: IEA, Baker Steel Capital Managers LLP. Note, *Europe includes European Union countries, Iceland, Israel, Norway, Switzerland, Türkiye, and the United Kingdom. Incudes BEV and PHEV.

The rapid growth of the EV market exemplifies this trend. 2022 saw 10 million EVs sold worldwide, around 14% of overall car sales, compared with just 4% in 2020. This year’s EV sales are expected to surge to 14 million, representing 18% of global sales, based on IEA forecasts. Given that an EV requires multiples of the amounts of metals used in an internal combustion engine (“ICE”) vehicle, including many speciality metals, manufacturers face a growing challenge to ensure secure access to production and processing capacity. Demand forecasts for critical metals have soared, with a 363% rise in lithium demand, a 60% rise in copper demand, and a 50% rise in nickel demand expected by 2030.

Which metals face fragile supply chains?

One of the most striking features of the green energy transition is the wide range of metals and materials required to produce technology and infrastructure relative to a fossil fuel driven economy. Use of copper, aluminium and precious metals in circuitry and electrification, along with lithium, cobalt, nickel and graphite’s use for batteries, is well-reported. Yet a multitude of other commodities are required across clean energy generation, storage and transmission, such as rare earth elements, notably neodymium-praseodymium (“NdPr”), and a range of speciality metals such as manganese, vanadium and platinum group metals (“PGMs”).

Many of these are rare, found only in relatively low concentrations in the Earth’s crust, making their extraction and production processes complex and costly. Other metals are more abundant, albeit with challenges arising from processing complexity and the utilisation of new technologies, as well as ESG concerns, particularly relating to environmental degradation and social impact, and geographical concentration which may cause geopolitical factors to arise.

The rapid development of green technology has caused demand forecasts for speciality metals to soar, particularly for those used in the production of lithium-ion batteries, which have seen costs come down significantly in recent years. This demand has driven many speciality metals’ prices to record highs over the past two years, however prices have now consolidated due to market factors, notably the end of EV subsidies in China at the start of 2023, and concerns over potentially weaker Chinese and global growth.

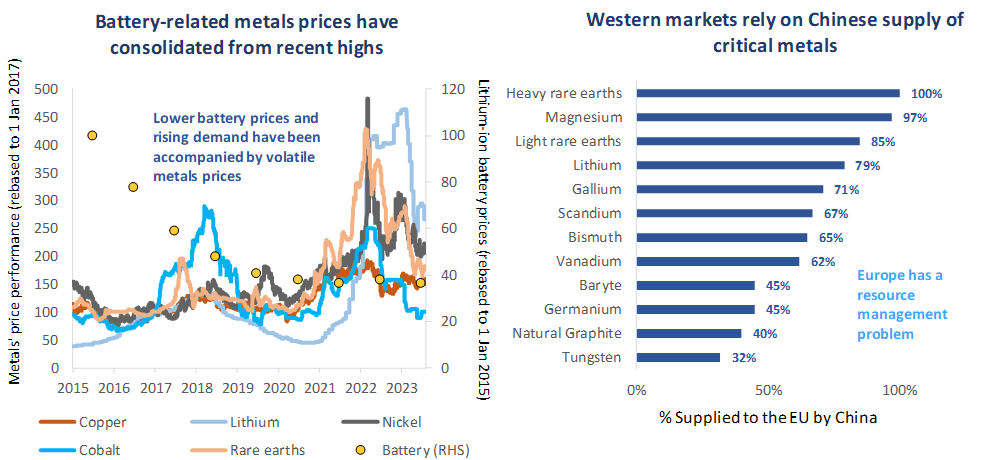

Figure 2

Source: European Commission, IEA, Bloomberg. Note, Lithium price refers to Lithium Carbonate Equivalent. Rare earth prices are represented by the China Praseodymium-Neodymium Oxide Market Price Shanghai.

Supply chain challenges are particularly acute for developed Western economies, in particular for the large technology consumer markets of the USA and Europe. These countries’ reliance on Chinese production of industrial components and consumer products is a rising cause for concern for policymakers and executives. Meanwhile geopolitical risks have come into increased focus following Russia’s invasion of Ukraine, which sparked an ongoing conflict in one of the world’s important commodity-producing regions. The result of this instability has been price volatility for many commodities, increasing uncertainty for manufacturers, and producers seeking to increase production.

China’s dominant position at the centre of supply chains for speciality metals is well-established. China is the world’s biggest producer of electric vehicles, batteries, solar panels and wind turbines, making it a crucial part of the supply chain for many green technologies. The country invested over USD 10 billion in the metals and mining sector during the first half of 2023 (Green Finance & Development Centre), more than the entire total for 2022, including investments in lithium, nickel, and copper projects, as well as uranium and iron ore. Investment in the metals and mining sector forms an increasingly important part of China’s Belt and Road Initiative, which has invested over USD 1 trillion in infrastructure projects. Alongside investment in securing supplies of critical raw materials, Chinese development of its domestic processing sector has continued to advance, reducing its reliance on foreign processors of metals, including copper, aluminium, lithium and others, while concentrating supply chains within the country. Chinese companies have also increased their efforts over the past decade to expand global network, joint ventures and partnerships.

China’s recent decision to limit the export of gallium and germanium, two metals used in microelectronic components for a range of products including semiconductors and solar cells, illustrates the tense industrial and geopolitical environment surrounding global supply chains. Gallium, germanium and many others are considered critical minerals by the USA, EU and other Western economies, yet China produces over 95% of the global gallium output and about 60% of germanium supply. Increased attention on potential military usage of metals is making disputes ever more tense, as illustrated by the EU’s classification of Huawei Technologies and ZTE Corporation as national security risks, deepening tensions.

A broader rise in resource nationalism is further exacerbating supply chain risk. The surge in demand for transition metals has propelled many countries rich with deposits of future-facing commodities into a position of influence. This shift in dynamics holds benefits for resource-rich nations, in terms of accelerating their own development. Argentina expects to begin operations at its first lithium-ion battery plant later this year, while Indonesia has been attracting investment from original equipment manufacturers (“OEMs”), including Ford and Hyundai to develop nickel processing facilities in the country. It has also prompted political efforts to control domestic supplies, as illustrated by Chile’s announcement earlier this year that it intends to semi-nationalise its lithium industry, and the DRC’s export ban on cobalt concentrates. While there has been speculation regarding new OPEC-style cartels covering minerals for the energy transition, such as in South America’s “lithium triangle” of Chile, Bolivia and Argentina, we believe this may be premature. The rapid pace of change underway in the battery technology sector creates a high possibility for substitution and new entrants.

In the USA and Europe political will is growing to redress the trade and production imbalance and improve supply chain security for critical raw materials. This is a significant challenge given China’s commanding lead in terms of production and processing, with substantial levels of investment needed to drive domestic exploration, discovery, mining and processing, as well as to fund technological development in these areas. The Inflation Reduction Act (IRA), passed last year, aims to build a clean energy economy through the use of tax incentives and funding programmes. This includes incentives and dedicated funding to accelerate EV adoption, drawn from the USD 369 billion allocated for climate investments. The Act sets targets for critical battery metals and minerals to be sourced domestically or from US free-trade partners, creating an urgent need for expansion of domestic supplies. In a similar vein to US policy, the EU’s Net Zero Industry Act, proposed earlier this year as part of the European Green Deal Industrial Plan, aims for at least 40% of the European Union’s clean technology demand to be met by domestic sources by 2030. Alongside regulation to boost domestic supply chains, developed countries remain committed to decarbonisation policies, most notably when it comes to phasing out ICE vehicles.

As long-term investors in the metals and mining sector we consider rising supply chain risk to be a key argument in favour of active investment management in the sector. Alongside the geopolitical risk factors addressed above, the dynamic nature of the speciality metals sector leaves producers open to substitution risk, as certain materials face the possibility of replacement in the production process, and from broader technological change. For these reasons we consider an active focus on asset allocation and stock selection to be crucial.

How are miners managing surging demand forecasts?

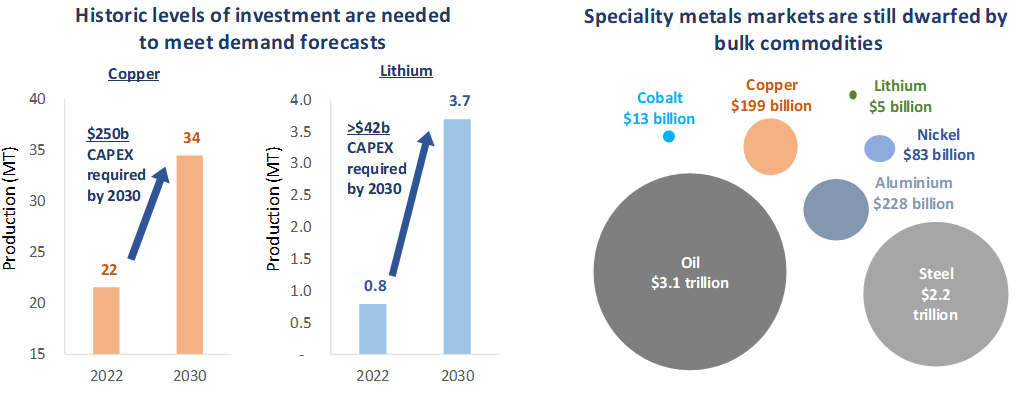

Speciality metals miners have largely performed well in recent years in terms of market capitalisation growth, profitability and ESG. In particular, the lithium sector, while volatile, has outperformed the broader mining sector. Despite encouraging performance by the sector, production growth has a long way to go if soaring demand forecasts are to be met. Historic levels of investment are needed across the speciality metals sector. For the lithium sector, which faces demand growth forecasts of around 4.5x by 2030 (compared to 2022), over USD 42 billion of CAPEX is estimated to be required. The situation for the copper sector is even more extreme, as the production increase of around 60% needed to meet demand forecasts will require around USD 250 billion of CAPEX (Benchmark Minerals). Furthermore, the scale of the growth needed in the speciality metals sector is highlighted starkly by the current size of the markets for lithium, cobalt, nickel and copper relative to oil and steel markets. Fossil fuels and bulk commodities dwarf speciality metals in size, yet demand forecasts imply this situation will change markedly over the coming decade.

Figure 3

Source: Bloomberg, Albemarle, BHP Billiton, Benchmark Minerals. Note, demand and CAPEX are forecasts. Commodity market size based on 2022 market value. Lithium demand forecasts are based on Lithium Carbonate Equivalent (LCE).

Positive changes are underway for speciality metals miners, indicating momentum is building in this fast-growing sector. A new wave of M&A is in motion as diversified miners, manufacturers, and technology companies seek to secure a reliable, diversified supply of speciality metals. With so much value across the mining sector at present we believe miners can benefit from consolidation, to increase scale and to position themselves for the strong period we believe lies ahead for commodity prices and to ensure speciality metals supplies can meet demand for batteries, EVs and broader green industry. Deals can potentially result in significant benefits to shareholders including production ramp-up, cost saving synergies, and valuation uplifts for miners. 2023 has seen a rise in M&A interest in the mining sector, with the lithium sector in particular focus (as addressed in our recent report which can be read here) prompted by recent lithium price weakness and substantial demand forecasts. Livent and Allkem’s USD 10.6 billion merger of equals, announced in May, offers a prime example of constructive M&A in the sector, with the deal creating the third largest lithium producer globally, in terms of estimated capacity.

A significant development for the speciality metals sector has been the sharp rise in direct investment by OEMs and energy companies into speciality metals projects and battery metals processing. Among car manufacturers, vertical integration is increasingly a focus, bringing battery production in-house where possible. Major investment in battery manufacturing sites is also underway, with a total of around USD 26 billion being invested by Toyota, Hyundai, GM and Ford, in the USA alone. Tesla is also increasing its focus on battery production and is aiming to cut costs. Direct investment and partnerships with mining companies and mining operations by car OEMs are also increasing, as manufacturers seek to secure supplies of speciality metals. Tesla has signed agreements with Albemarle, a leading lithium miner, and Prony Resources, a nickel producer. Stellantis has invested USD 55m into Vulcan, a German lithium miner, while Ford has partnered with Vale and Huayou to construct a nickel processing plant in Indonesia.

Alongside increased attention from investors on the speciality metals sector has come an improvement in ESG performance by miners. As active investors in the mining sector, we are convinced that producers of the metals and minerals for a sustainable future should aim to operate in accordance with the highest standards with regards to ESG. We consider that sustainability professionals in the investment world must increasingly engage and partner with mining companies, advocating for an expansion of the production of critical metals and minerals in a sustainable and ethical manner. Entities such as the International Council on Mining and Metals and the Responsible Mining Initiative have a central role to play in this process, as do active investment managers such as Baker Steel.

Amid the many drivers and positive developments for the speciality metals sector, it remains highly likely that supply will frequently fail to match the level of demand for critical metals over the coming decade. We believe higher prices are likely for many metals, and consider there is a real possibility for price spikes in certain speciality metals, as the supply chains for the green energy transition are established and developed.

Momentum is building – Over 4 years of investing in speciality metals equities

It has been almost 4 and a half years since Baker Steel launched its speciality metals equities strategy, the Baker Steel Electrum Fund, with a vision to offer investors exposure to the producers of critical metals and materials needed for a sustainable future. The Electrum strategy builds on decades of active management experience and bottom-up investment research in the mining sector by Baker Steel’s team, while adding a top-down overlay ensuring tactical as well as strategic asset allocation is focused on those sub-sectors of the industry which stand to benefit most from secular growth trends, most notably linked to the expansion of green technology. ESG research, using our proprietary in-house ESG screening and scoring tool, is a key element of the investment process, which is fully integrated into investment decision making.

The Baker Steel team through its Electrum Fund strategy has delivered strong risk-adjusted performance over the medium-term, relative to its index and has attracted substantial assets since its launch in 2019. This success has been the result of a combination of factors; our value-driven investment philosophy, proprietary research tools and active investment approach have been central. Yet, it is the technical prowess of our team which we believe to be the biggest driver of investment success. As an independently owned firm our Managing Partners, as Fund Managers, are closely aligned with our investors, and with the Baker Steel Investment Team having expanded this year, we have ensured our research capacity is growing with the strategy and with the sector’s progress.

Today the outlook for the speciality metals sector and prospects for miners has eclipsed our original expectations, when launching the Electrum Fund strategy in 2019. The roll-out of green technology, most notably EVs and battery technology, has gained momentum rapidly sending demand forecasts for critical metals soaring. As the sector moves towards what we believe will be a new commodity supercycle, led by the metals and minerals required for the clean energy transition, Baker Steel’s team continues to deliver our unique and value driven investment approach, to the benefit of our clients, while adhering to sector leading ESG practices.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.