Will the rush for precious and speciality metals spark a new bull market for miners in 2024?

The clean energy transition, supply shortages, and a major macroeconomic shift all point towards strong performance by mining equities in 2024.

2023 delivered a range of surprises for investors as the US banking crisis, China’s disappointing economic reopening, and multiple conflicts, buffeted markets. These events were accompanied by volatility caused by speculation over monetary policy direction, as central bankers, led by the US Federal Reserve, battled to tame rampant inflation.

We begin 2024 with global equity markets in a bullish state, in anticipation of lower interest rates, lower inflation, and a “soft landing”. Whether this euphoria lasts or fades, we believe a bull market phase for metals and mining is approaching. US interest rate cuts have historically given a significant boost to many commodity prices and to miners, particularly the precious metals sector. Meanwhile the seemingly unstoppable momentum of the clean energy transition continues to drive historic demand forecasts for the speciality and battery metals sector.

Key themes for the metals and mining sector in 2024:

- The green revolution is gaining pace – COP28 reinforced commitments to decarbonise and transition to clean energy. Mining is a crucial part of the path to net zero, and demand for speciality metals is forecast to soar.

- Short-term oversupply of certain battery metals will ease – Rapid investment in battery metals production, coupled with weak Chinese growth, caused oversupply for many metals in 2023. We see this reversing in 2024.

- Supply-side challenges are growing – Miners face low discovery rates alongside strict permitting regimes and rising resource nationalism. Higher incentive prices are needed for many commodities to meet demand.

- US interest rate “pivot” is a catalyst for metals and miners – Notably precious metals have historically benefitted from rate cuts. During the past 3 cycles gold gained over 50% in the years after a rate hike “pause”.

- Miners appear undervalued – While certain sub-sectors have thrived, two years of consolidation for mining equities has created significant opportunities as tailwinds for miners start to increase. Margins are robust, balance sheets largely healthy, and ESG performance is improving.

After consolidation in 2023, the mining sector is poised for recovery

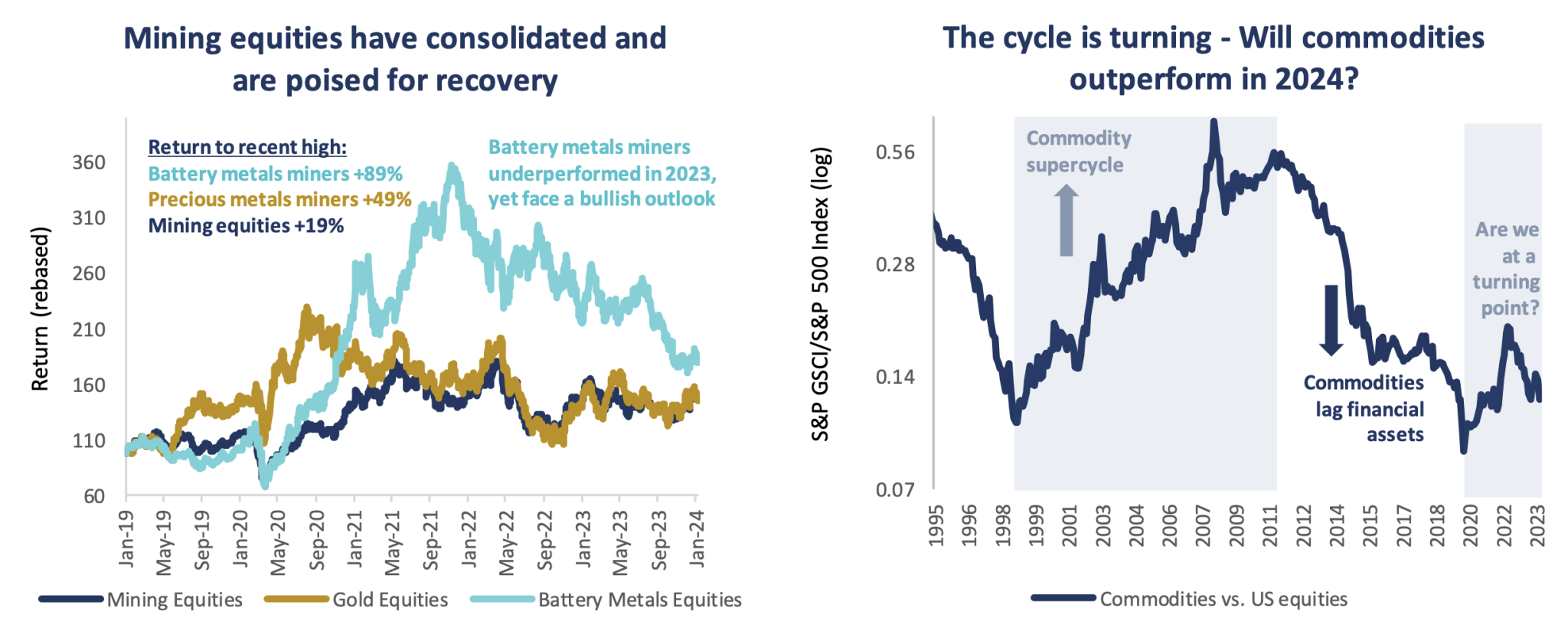

Figure 1

Source: Bloomberg, Baker Steel Capital Manager LLP. Data at 31 December 2023. Note, precious metals miners are based on the MSCI ACWI Select Gold Miners Index, mining equities are based on MSCI ACWI Metals and Mining Index, Battery metals miners are based on Global X Lithium & Battery Tech ETF.

Much of the mining sector has been in a period of consolidation for the past two years. There have been several “false starts” for recovery, such as the rally in early 2023, led by precious metals in response to the US banking crisis and periodic speculation regarding the timing of the end of the US rate hike cycle. Yet the twin headwinds of central banks’ determination to raise interest rates to combat inflation, and a lacklustre outlook for global economic growth have kept pressure up on the miners’ share prices, which have now retraced significantly from the highs of the past few years.

Notably, battery-related metals miners, such as lithium, nickel and cobalt producers, have faced the largest sell-off. To regain all-time highs, battery metals miners would have to rise +89% in nominal terms, and +111% in real terms. Precious metals would have to rise +49% in nominal terms and +78% in real terms, while diversified mining would need to rise +19% in nominal terms, +28% in real terms (in USD terms ). With investor sentiment showing signs of starting to turn, the sector’s recovery potential in the near-term is significant. Yet, in our view, a recovery to recent highs would represent just the first step towards the new bull market which we believe is approaching for the metals and mining sector. The new bull market will be backed by significant forecast supply deficits for critical minerals, commitment to net zero policies by governments across the developed world, geopolitical fragmentation and ongoing economic imbalances.

As the new year gets underway, we consider that the shifting macroeconomic environment offers near-term catalysts for metals and mining, most notably the end of the US interest rate hiking cycle, which has historically boosted investor sentiment towards mining equities. Yet, uncertainty is likely to persist and undoubtedly investors will continue to face surprises in the months ahead. Economic risk is high and markets face a mixed outlook for growth, whether recession is avoided or not. The outlook for inflation is similarly uncertain, yet the current progress towards taming price rises appears sufficient to bring about the end of the rate hike cycle. Alongside economic and market uncertainty, 2024 will almost certainly be a year of turbulent geopolitics, with elections in 76 countries and over half the world’s population poised to vote during the year . This includes the US presidential election, EU elections, and elections across the BRICS, which promise to impact financial markets, potentially causing volatility and heightened risk.

The world’s hunger for speciality metals is rising

Mixed performance by speciality metals miners in 2023 belies the historic forces driving demand growth forecasts for these commodities, as efforts to reach net zero and ensure energy security gain pace. At the end of the hottest year on record, the recent COP28 summit concluded with a commitment to transition away from fossil fuels, including phasing out certain fossil fuel subsidies, reinforcing the political will behind the clean energy transition. In many ways the momentum underway appears unstoppable, in terms of forecast electric vehicle (“EV”) usage, ramp-up of renewable energy capacity, and roll-out of green infrastructure by the end of this decade.

Slowing economic growth will not stop the major structural shift toward decarbonisation

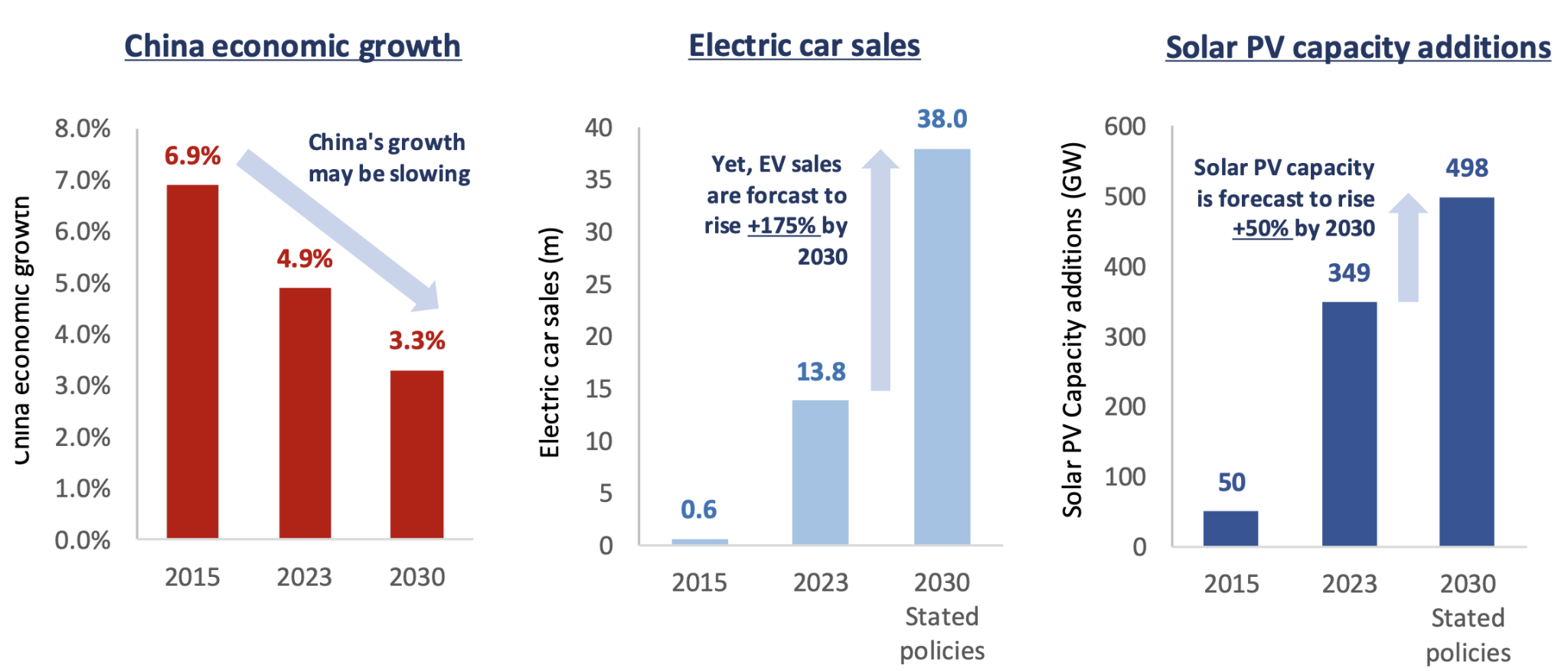

Figure 2

Source: IEA, World Energy Outlook, October 2023.

The green revolution is the most significant long-term driver for the mining sector, given the critical role of metals and minerals for the development of green technology and expansion of renewable energy capacity. Yet the prospect of slower global economic growth casts a degree of uncertainty on the timing and scale of demand for natural resources. The outlook for China’s economy is particularly significant for 2024. China’s growth may be slowing, yet the country is progressing swiftly towards a cleaner development model, with existing government policies having already established the trajectory for clean technology adoption. This trend is highly supportive for speciality metals, in particular those required for green technology. Since the beginning of 2017, China has seen more than 18 million EV sales, which is around half the global total and over four times more than the US. By 2026, it is estimated that over 50% of all new passenger vehicle sales in China will be electric, compared to a little over a quarter in the US. China’s rapid expansion of EV usage has been accompanied by a rollout of vast charging networks to accommodate the shift away from the internal combustion engine. China accounted for 68% of the global total of EV charging networks in 2023, up from 63% in 2020 and just 27% in 2015.

Despite this rapid progress, China’s development of green infrastructure has a long way to go. The country still consumes more than half the world’s supply of coal, which accounts for about 60% of its power generation . Therefore, even at a slower economic growth rate, China’s seemingly unstoppable shift towards clean development and the resulting demand for the metals required for electrification, battery technology and renewable energy, will be transformational for the mining industry in the years ahead. Alongside this supportive picture for speciality metals, China also offers near-term potential catalysts for broader industrial commodities if policymakers opt for increased economic stimulus in 2024. There are already signs that support is increasing, with USD 50bn in stimulus injected into policy-focused Chinese banks during December 2023, the largest amount in over a year.

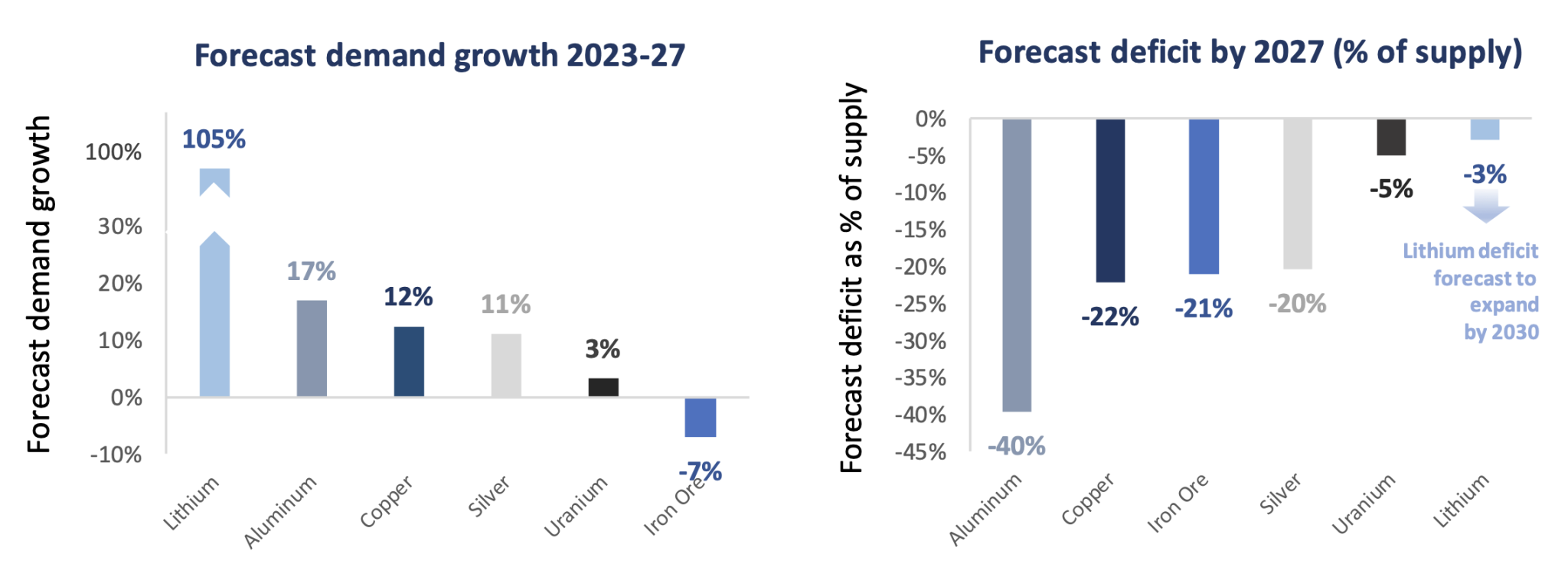

Rising demands for critical metals is driving deficits by 2027

Figure 3

Source: BMO, BNEF, Baker Steel Capital Managers LLP.

Given this supportive medium- to long-term demand dynamic, mining equities’ recent mixed performance may come as a surprise to investors in this sector. In some cases, the short-term outlook has proven challenging, as temporary oversupply in some markets overshadows the longer-term forecast supply deficit. The lithium sector provides a prime example of the mismatch between short-term and longer-term supply and demand outlook. Despite forecast lithium demand growth of over 300% by 2030 , the lithium price’s weakness has persisted due to growing inventories and slower EV sales growth. While headwinds persist, we anticipate a pick-up in the lithium sector in 2024 amid possible strong restocking volume, as major producers increase efforts to secure lithium supply for their core expansions. Furthermore, M&A remains a key theme for the lithium sector in 2024 as miners, energy companies and car manufacturers vie to secure supplies of critical battery metals.

Similarly, the short-term outlook for nickel and cobalt, two critical metals commonly associated with battery technology, remains challenging. The global nickel market faced oversupply in 2023 due to a surge in Indonesian output and Chinese Class II nickel products. This surplus is expected to continue in 2024, amid more projects and fewer supply disruptions . However, there are factors supporting nickel prices in 2024, including the increased use of nickel in EV batteries and stainless-steel applications, especially from China, which may counter the impact of production growth. Cobalt faced a similarly oversupplied market in 2023, due to new cobalt supply in Indonesia driven by Chinese investments and weaker than expected battery demand.

In contrast, certain speciality metals faced sizeable supply deficits during the year, which appears likely to persist in 2024. Uranium was a stand-out commodity during 2023, with prices having reached a 15 year high in December 2023. Market conditions have tightened amid supportive demand and supply dynamics during the year, with investment in new nuclear reactors from major economies and a supply deficit. We expect this trend to continue, as nuclear energy deployments broaden out to more countries, and as utilities seek to reduce exposure to Russian sources. A +27% increase in uranium demand is estimated between 2021 and 2030, reflecting a +16% increase in reactor capacity .

In 2024, a range of supply chain challenges are expected to continue to impact critical metals markets. Alongside the familiar challenges, such as resource nationalism, China’s dominance of battery metals processing, and the disruption caused by the ongoing Russia-Ukraine conflict, global trade now also faces threats to major shipping routes in the Red Sea. With numerous potential flashpoints, most notably escalation of the current conflict in the Middle East and US-China tension over Taiwan, we consider that price spikes for critical commodities may become a theme in the year ahead. As long-term active investors in speciality metals equities, we seek opportunities for our investors while recognising that volatility and temporary setbacks are to be expected, as these nascent “future-facing” metals undergo a transformation to meet historic demand forecasts. Our belief is that the actively managed rotation between sub-sectors of the mining industry is needed, to focus exposure on those sub-sectors best positioned to thrive.

As gold moves from resilience to recovery, will precious metals equities deliver outsized returns?

The precious metals sector starts 2024 in a strong position. The gold price has remained resilient throughout the US rate hike cycle, touching a new high in US dollar terms in December 2023, while silver prices have likewise recovered well from the lows of 2022. Precious metals equities are showing signs of recovery, having faced weakness for much of the past two years as rising interest rates and inflationary pressure on mining operations dulled investor sentiment towards the sector.

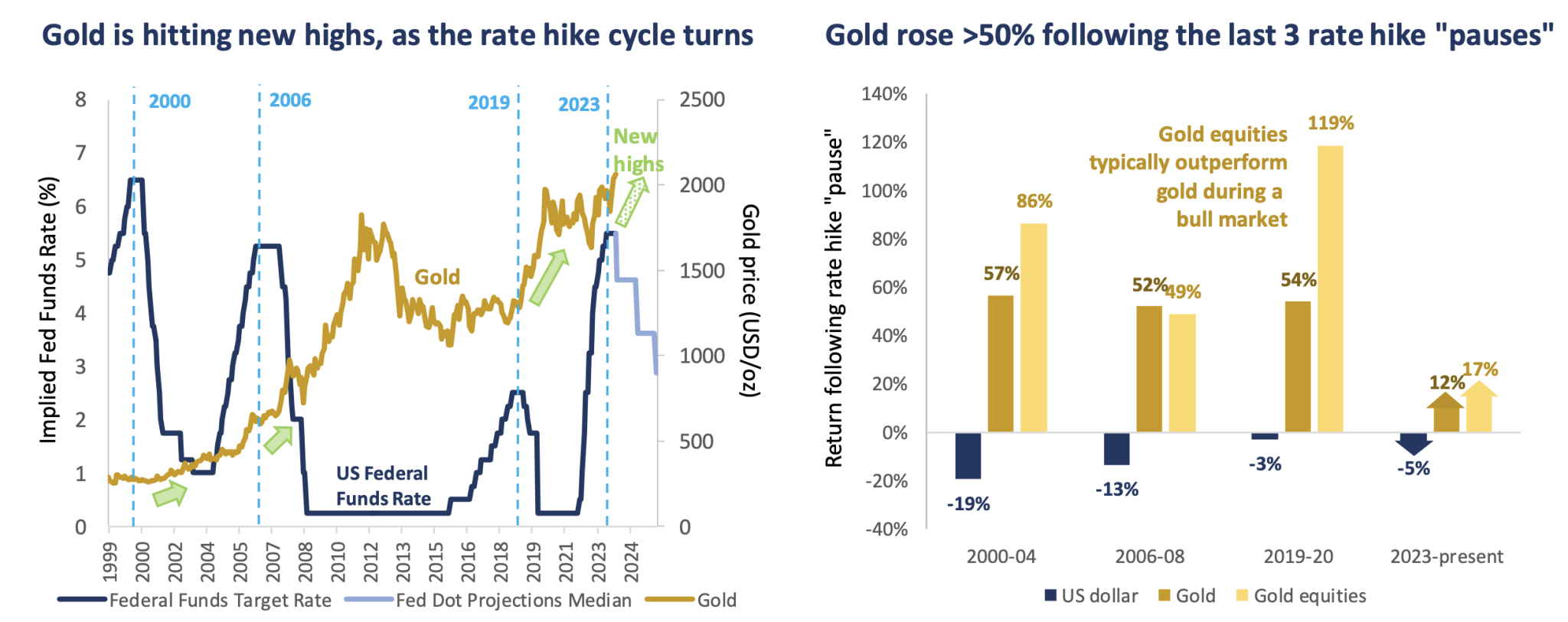

Today the precious metals sector finds itself at an important juncture. On the macroeconomic front, the end of US interest rate hike cycles has historically pushed gold to new highs. In the past three cycles, gold rose over +50% in the aftermath of a “pause” in interest rate hikes. With conviction building that the US Fed will not hike further, we anticipate that a shift towards looser monetary policy, along with a potential end to quantitative tightening, will be a key driver for gold and silver prices in 2024. Precious metals also tend to perform well amid economic and geopolitical uncertainty. Economic risk is rising across developed markets, and we believe the full impact of the sharp rise in borrowing costs remains to be seen. Confrontational geopolitics appears likely to continue, offering a further near-term potential boost for precious metals.

Figure 4

Source: Bloomberg, Baker Steel Capital Managers LLP.

The outlook for the US dollar remains significant for precious metals and miners. The surge in US dollar strength in 2022 and 2023 proved a headwind for the precious metals sector, yet we see indications this trend may be turning. With interest rate cuts approaching, risks to US growth, and accelerating US debt growth, we consider there is a strong chance of a weaker dollar in 2024. Longer-term, the trend towards de-dollarisation shows signs of gaining traction, as the US share of global trade retreats and as many emerging market central banks reduce US treasury holdings.

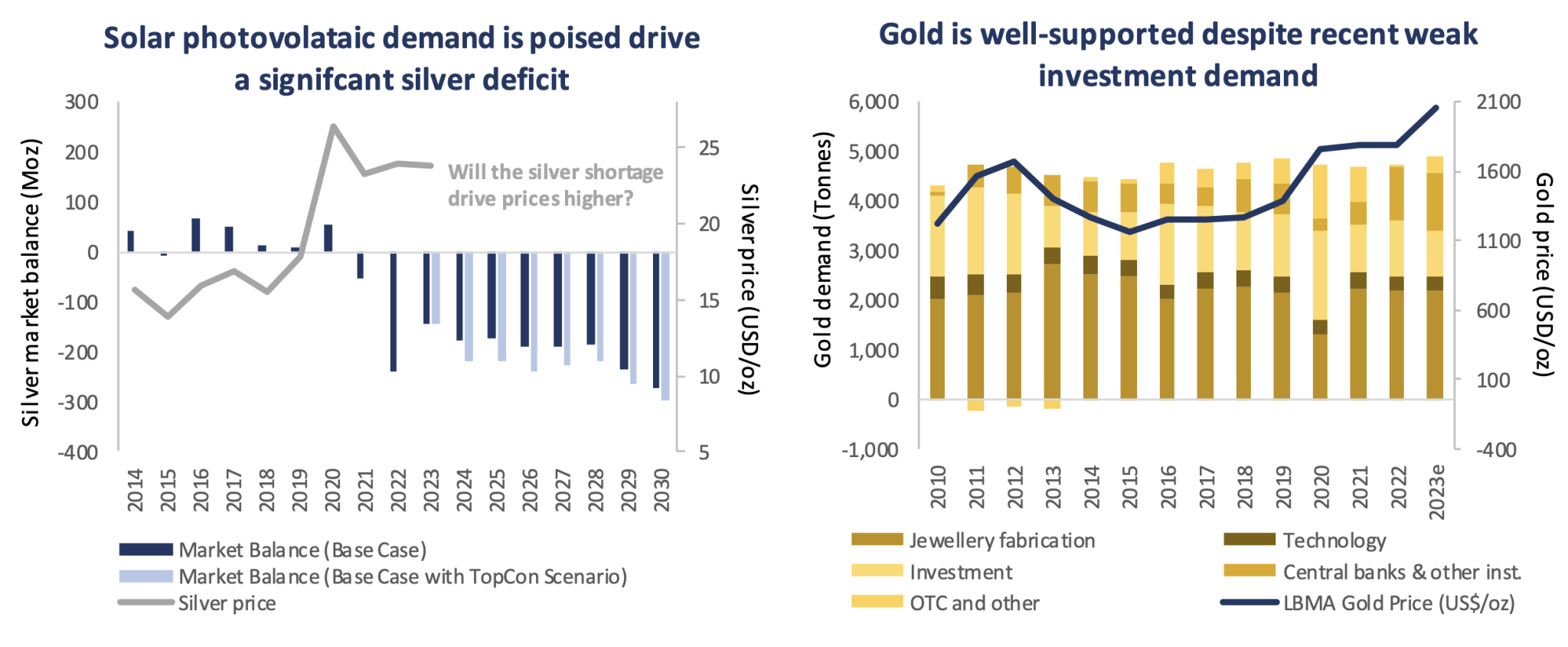

Regarding demand and supply for physical gold and silver, we see supportive dynamics for both metals. Physical gold demand remains robust, as gold jewellery consumption continues to recover from COVID lows, amid higher local prices (e.g. yuan, rupee), and with central bank buying potentially having reached another record high in 2023. Investment demand for physical gold has been subdued in recent years, however with signs that investor sentiment is turning we anticipate a recovery of bar and coin purchases in 2024. On the supply side gold mine production appears likely to rise modestly in 2024, amid an expansion of existing projects in North America.

The physical silver market is likewise positioned supportively for higher silver prices. The largest source of silver demand is for industrial use, across an array of electronics, and the most significant area of demand growth being from the solar energy industry, for use in photovoltaic cells. It is estimated that solar capacity will have to increase around 3.5x by 2030 (to 3.8tw) to stay on track for net zero (BNEF), which will result in an approximate doubling of silver demand for photovoltaic cell manufacturing, taking into account thrifting for other metals, such as copper, and the learning curve, which brings cost reductions. The result is a forecast deficit for the silver market in the years ahead, which we believe will reach almost 300Moz by 2030. With annual silver supply forecast to remain at around 1boz to 1.1boz in the coming years, current silver prices are not high enough to incentivise the production growth required to meet rising industrial demand for silver, particularly from solar photovoltaics. Given silver is currently trading at around half its all-time high, while gold has hit new highs in recent months, we see a major opportunity for investors in silver equities as the sector shows signs of starting to catch up.

Figure 5

Source: Silver Institute, World Gold Council, Baker Steel Capital Managers LLP.

With physical gold and silver prices appearing well-supported for price appreciation in the year ahead, the question remains as to whether precious metals miners will deliver outsized returns, as they have done in previous gold bull markets. Undoubtedly, precious metals equities have faced a challenging period over the three years, illustrated by the fact that despite the gold price having hit new highs in recent weeks, gold equities would need to return 52% to return to their all-time high (in USD terms) . While this has at times been a frustrating environment for long-term investors in the gold mining sector, as we are, we consider our key objective as active investment managers in this environment has been to successfully maintain the fundamental upside potential of our precious metals equities strategy, while seeking to minimise risk without being overly defensive; something we successfully achieved in 2023.

On a fundamentals basis, gold miners appear undervalued. Using a price-to-NAV (P/NAV) basis, gold miners’ valuations have declined -32% from their 2020 highs, indicating a collapse in sentiment towards the sector and a de-rating of the shares. This has occurred despite physical gold’s resilient performance over this period in the face of rising US interest rates and US dollar strength. The P/NAV deterioration has also occurred despite the miners themselves offering healthy margins and balance sheets, growth, ESG performance and dividends, while constructive M&A continues.

With gold and silver miners offering value and substantial upside potential, we believe the outlook for the sector is more positive than it has been for many years – likely since the end of the last US rate hike cycle in early 2019. But beyond the supportive macroeconomic themes, we consider that the current state of the precious metals sector offers opportunities for active management to add value. You can read more about our views on the gold sector in our recent article “Gold at a turning point” here.

A supportive outlook for metals and mining in 2024

Investors face an array of questions at the start of 2024: How far and fast will central bankers cut rates? Will the US and other developed economies achieve a “soft landing”? Will economic slowdown and potential crises prompt accelerated rate cuts and new economic stimulus? As has been the case in recent years, investors should also expect geopolitical events to continue to deliver surprises. Overall, we consider the balance of probability lies in favour of a strong year for speciality and precious metals in 2024. Doubts remain about whether inflation has been tamed, yet interest rates appear likely to fall in the coming months, creating an environment which has historically benefitted commodities and miners, particularly precious metals miners.

Across a range of scenarios, we consider that mining equities are positioned for a period of strong performance. A soft-landing scenario would benefit industrial and speciality metals amid a rosier outlook for global growth, as well as remaining a supportive environment for precious metals, which tend to gain during periods of inflationary growth. A hard landing, bringing economic slowdown and potentially recession, would present a short-term headwind for certain industrial metals, however we believe that sub-sectors of the metals and mining industry, particularly those linked to the green energy transition would still deliver strong returns under this scenario. Efforts to reach net zero are now firmly entrenched in policy, both across the developed world and in China, where the adoption of a cleaner development model presents a highly significant long-term driver for speciality metals demand. Furthermore, should the growth outlook weaken as economic risks rise, we also consider that precious metals stocks stand to outperform broader equity markets, as the gold price moves higher, interest rates fall further, and particularly if the US dollar were to weaken.

As we approach what we believe will be a supportive environment for precious and speciality metals miners in 2024 and beyond, Baker Steel’s team continues to deliver our unique and value driven investment approach, to the benefit of our clients, while adhering to sector leading ESG practices. As a team with multi-cycle investment experience, we know that investment success in this sector is typically the result of a combination of factors. Our value-driven investment philosophy, proprietary research tools and active investment approach have been central. Yet, it is the technical prowess of our team which we believe to be the biggest driver of investment success. As an independently owned firm our Managing Partners, our Fund Managers, are closely aligned with our investors, and with the Baker Steel Investment Team having expanded this year, we have ensured our research capacity is growing with the strategy and with the sector’s progress.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.