Uranium is booming – What’s next for the other metals needed for the clean energy transition?

Producers of the vital element for nuclear power have been outperforming as demand for clean energy rises. We compare the drivers for uranium with the outlook for lithium, the “flagship” element of the green transition, and with silver, the potential “unsung hero”.

The transition away from fossil fuels towards clean energy is a transformative force for commodity markets, impacting a wide range of metals and materials. Many are well-known, such as copper for electrification, and lithium, nickel and cobalt for battery production. Others are lesser known, such as silver for solar panels, uranium for nuclear power, rare earth elements for magnets, graphite for battery anodes and vanadium for green construction and batteries. While each of these commodities face supportive long-term demand trends, in the short-term divergences in outlook can occur due to individual market dynamics. In this commentary we will seek to:

- Explore the forces driving the uranium bull market.

- Examine how the silver sector faces a transformational rise in demand from solar photovoltaics.

- Explain why a short-term surplus has created an opportunity in the lithium sector.

The current strength of the uranium sector illustrates the impact of the clean energy transition on commodities, amid a resurgence of interest in nuclear energy among policymakers. Demand forecasts have risen, causing a supply deficit and sending uranium and uranium miners into a new bull market. As active investors we seek opportunities in metals such as uranium, with strong structural demand trends, through investments in mining equities which offer operational leverage to rising commodity prices and “pure play” exposure to the clean energy transition.

Uranium’s strong performance highlights the impact of the clean energy transition on critical minerals –

- Rising nuclear demand has pushed the uranium market into deficit – The deficit will likely persist as nuclear capacity expands, and as technological innovation allows next generation reactors to be developed.

- An upcycle for uranium miners – Uranium miners have demonstrated that commodity equities can offer effective exposure to rising commodity prices. Profitability appears likely to remain strong.

- Active asset allocation across sectors – Disparities in performance between commodities make a strong case for active investment management in the metals and mining sector.

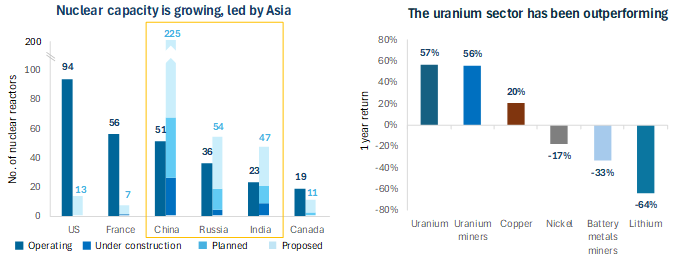

Figure 1

Source: Growing Demand for Nuclear Energy. Bloomberg. Data at 19 June 2024.

Uranium’s new dawn – From bust to boom

The growing popularity of nuclear energy as a reliable and low-carbon energy source comes as policymakers around the world grapple with a range of energy crises, from cost and security of supply to decarbonisation efforts. The resulting rise in planning of new nuclear plants, led by Asian nations, has caused uranium and uranium miners to outperform the other metals commonly associated with the clean energy transition, such as lithium and nickel.

Having fallen out of favour with policymakers and the public for much of the last decade in the wake of the Fukushima disaster in 2011, nuclear energy is now seeing a rising number of new projects. Nuclear offers low carbon, round-the-clock, base load power, which cannot currently be offered by renewables such as wind or solar, offering a country’s power grid an effective replacement for coal and gas fired power stations.

In the West, existing nuclear reactors are undergoing refurbishment and projects’ operational lives are being extended. The US and France, the largest operators of active nuclear energy plants, have both proposed expansion to nuclear capacity, including a commitment by the US to invest up to USD 2.7b to boost domestic supplies of uranium, reducing reliance on Russian imports. Similarly, Australia’s recent announcement that it will build seven new reactors highlights the pivot underway towards nuclear energy[i]. Yet it is in the East that momentum is really building for the nuclear sector, with China, India and Russia all undertaking ambitious expansion programmes for their nuclear industries. Overall, around 60 reactors are under construction globally, with a further 110 planned. As shown on the chart above, the majority of these projects are found in Asia.

A number of factors have contributed to policymakers’ embrace of nuclear energy as a core element of the future energy mix. Firstly, Paris Agreement commitments to combat climate change are stoking efforts to increase low-carbon energy production. Second, the Russia-Ukraine war brought into sharp focus the necessity of pursuing energy security and reducing reliance on foreign fossil fuel imports. With geopolitical tension remaining elevated, no let-up in the Ukrainian conflict, and with a high risk of escalation in the Middle East, this theme is unlikely to fade in the short- to medium-term. Third, new technologies, most notably small modular reactors (“SMRs”), are developing swiftly and offer significant potential for integration into energy systems providing low-carbon electricity with a constrained footprint.

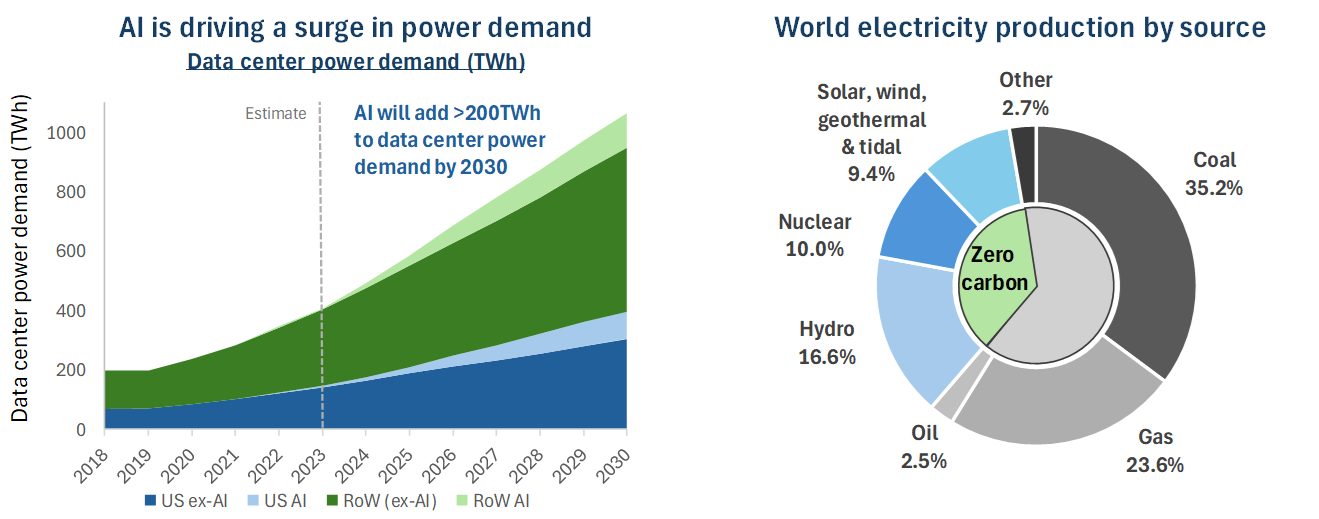

Moreover, global energy demand growth is accelerating. Population growth, alongside rapid urbanization and industrial growth in developing countries will remain a key driver of energy demand. Another notable factor for energy demand is the growth of AI, which is forecast to require an additional >200TWh of power for data centres by 2030. AI’s thirst for reliable clean energy is illustrated by major technology companies’ initiatives to secure nuclear sources. In January 2024, Microsoft hired a Director of Nuclear Technologies to oversee the development of SMRs to provide power for its data centres. Similarly, in March 2024, Amazon acquired a nuclear-powered data centre in Pennsylvania.

Figure 2

Source: Masanet et al. (2020), Cisco, IEA, Goldman Sachs Research. World electricity production by source based on 2020.

While currently only accounting for around 10% of global electricity production, nuclear energy’s offer of low-carbon base load power and high energy density make it an attractive proposition for policymakers, alongside renewable energy sources, to replace fossil fuel energy production. The nuclear power market is forecast to grow by around 16.4% between 2023 and 2030[ii]. With growing political and public support for nuclear, alongside governments’ commitment to upgrading plants and building new capacity, nuclear energy’s contribution to the future energy mix appears likely to increase.

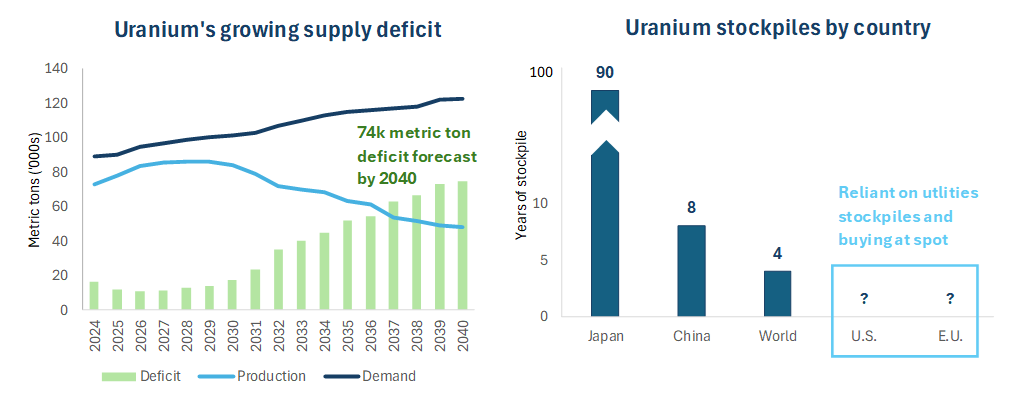

What does the uranium market deficit mean for miners?

Meeting the rising demand for uranium for nuclear energy presents challenges and opportunities for the mining sector. The deficit for the uranium sector is estimated to be 22.5% of supply in 2024[iii]. Uranium supply forecasts, even taking into account the restarting of idled mines, indicates the deficit will persist in the years ahead before expanding significantly in the 2030s. New uranium supply is forecast to come online from mines under development and from planned and prospective mines, yet the sector faces numerous challenges in expanding supply. Uranium’s limited production is concentrated geographically, with Kazakhstan, Canada and Australia among the largest producers, and depletion of existing uranium resources is an issue, as some mines near the end of their productive lives. Meanwhile, new uranium projects face significant regulatory and environmental hurdles. Given the challenging environment, it is estimated to take 10-15 years for new mines to become operational. Notably Kazatomprom, a major Kazakhstan-based producer, recently highlighted flagged construction delays and limited availability of key chemical reagents, when it downgraded its production guidance earlier this year.

Figure 3

Source: UxC, Q3 2023, World Nuclear Association, Ux Consulting, OECD Nuclear Energy Agency, International Atomic Energy Agency, RBC, Baker Steel Internal research.

Uranium supply is also impacted by strategic reserves and stockpiling by governments and utility companies. Countries with large nuclear sectors aim to maintain strategic reserves of uranium for energy security, a trend which appears likely to grow amid the rollout of new nuclear energy capacity. Likewise nuclear power utility companies aim to secure long-term contracts and build inventories to weather supply challenges. Understandably governments and companies tend to keep information on uranium inventories confidential, however analysts estimate that global uranium inventories last around four years[iv], with the US and EU most reliant on utility company stockpiles and buying at spot price in the market. Given rising concerns over energy security, we consider it likely we will see more cases of governments and utility companies having to scramble to secure supplies in an environment of tightening market balance, potentially pushing prices significantly higher.

The growing uranium supply gap has so far proved beneficial for uranium miners’ share prices, which have been driven upwards for much of the past year. Meanwhile, the announcement of Paladin Energy’s CAD 1.1 billion acquisition of Fission Uranium merger in June, highlights that constructive M&A activity can bring opportunities for investors in uranium equities. Uranium miners present a clear example of how exposure to a sub-sector of the mining industry can deliver exposure to an imminent market imbalance driven by the clean energy transition.

As active investors in the metals and mining sector, we see opportunities across a range of sub-sectors at present, despite the fact that certain key battery metals, notably nickel, currently face oversupplied markets. Baker Steel’s “Electrum” investment strategy actively adjusts its sub-sector exposure across the mining sector, to give our investors exposure to those metals and minerals we believe face the clearest near-term catalysts and long-term demand drivers, while minimising exposure to sectors likely to face weakness. The following sections address two of the sub-sectors of the mining industry, silver and lithium, where we currently see opportunities for growth and share price re-rating.

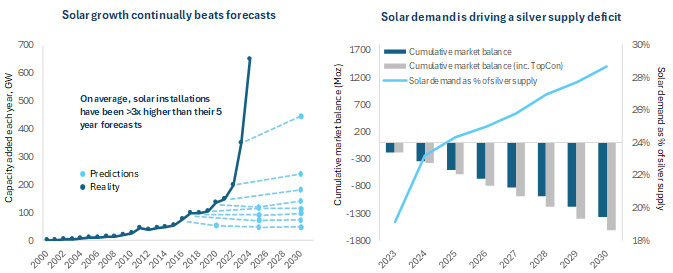

Silver and the solar energy revolution – A structural market imbalance

Silver faces one of the most significant structural demand trends as a result of the clean energy transition, yet the magnitude of the long-term market imbalance remains under-appreciated. Silver is a key component of solar photovoltaic (“solar PV”) cells, with each solar panel estimated to contain c.20grams of silver[v]. This adds up to an estimated 233moz of silver needed for solar panel production during 2024, up from 75moz five years ago[vi]. This is a large increase, yet it is the exponential growth facing the solar energy sector which give a glimpse into the incredible demand dynamic underway for silver.

The development of solar energy capacity so far has been truly remarkable. In 2004 just 1Gw of solar capacity was installed globally; by 2010 1Gw took one month to install and by 2016 just one week. In 2023 there were single days which saw 1Gw of capacity installed. For 2024 it is estimated that 520-655Gw of capacity will be installed[vii]. Overall, researchers have observed that installed solar capacity is doubling every three years[viii].

Ultimately solar’s success stems from the fact that it becomes cheaper the more that is produced, thereby boosting demand. This phenomenon is known as the “experience curve”, and typically measures the fall in unit cost which accompanies a doubling of cumulative production. A recent report by The Economist measured this rate at over 40% today, assuming 2000 as the starting point[ix]. Following subsidies in the early days of solar energy, the sector now finds itself at the point of exponential growth. Its benefits as a renewable energy source go far beyond the transition to net zero; it will increasingly make economic sense for businesses and consumers to embrace solar. Standardisation of solar cells also helps with expansion across industries, in a manner which cannot so easily be replicated by fossil fuels.

Figure 4

Sources: IEA, Energy Institute, The Economist, BNEF, Baker Steel internal forecasts.

The impact of such explosive growth on the silver market appears transformative. Solar PV demand has the potential to underpin the silver market, in a similar manner to the underpinning of the gold market by central banks buying. To illustrate this point, in 2024 we estimate that 23% of silver supply is absorbed by solar demand, a comparable proportion to the amount of gold supply purchased by central banks. Yet by 2030 we estimate that solar demand will have risen to 29% of total silver supply or potentially higher if silver intensive “TOPCon” technology, which increases the efficiency of solar cells, becomes increasingly prevalent.

The silver market supplies just over 1Boz per year, yet with the rapid expansion of solar we estimate the expansion of solar could cause the cumulative silver market deficit to reach between 1.4Boz and c.1.6Boz by 2030[x]. Alongside the forecast 49% increase in silver demand from the solar energy sector by 2030, compared to 2023, the metals usage in other green technologies is also forecast to increase. Demand for silver from the auto industry is expected to rise by 31%, boosted by increased electric vehicle (“EV”) production, alongside a forecast 77% increase in demand for silver for use in mobile phones networks, amid the rollout of 5G[xi]. Backed by significant demand growth and with a persistent deficit forecast, the outlook for silver prices and silver miners appears positive. The physical silver price has made strong gains in recent months, yet unlike gold, remains significantly below its all-time highs. Silver miners have already started to outperform, having returned 22.3% over the past 12 months, compared to broader precious metals equities which returned 19.9%[xii].

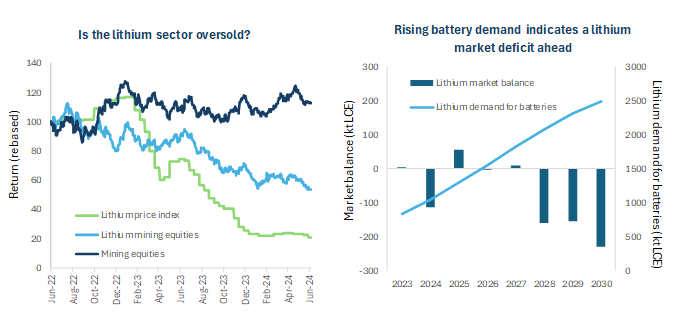

Is the lithium sector oversold? Battery expansion presents a historic demand trend

The second sub-sector we believe warrants particular investor interest at present is the lithium sector. Lithium is closely associated with the clean energy transition due to its role as a key component in lithium-ion batteries, the most common battery technology used in cars, mobile devices and in energy storage. Yet lithium prices have undergone a significant price pull-back over the past two years, while lithium miners’ share prices have continued to suffer.

Given the positive demand outlook for the lithium sector, this weakness may prove overblown, the result of temporary oversupply in a nascent industry. The total traded lithium market was just USD 8.8B in 2023 but is forecast to expand to over USD 23B by 2030[xiii]. This rise is primarily driven by rising demand for battery capacity as renewable energy sources, in particular solar, gain a greater market share. Falling battery costs are critical to demand expansion, illustrated by that fact that the cost of a kilowatt-hour of battery storage having fallen 99% over the past 30 years[xiv]. The “experience curve” brings significant cost benefits to lithium-ion batteries, similar to solar cells, and mass production of batteries by China, a key element of the country’s industrial strategy, has delivered swift growth. Notably, certain regions of China now mandate that battery capacity must be installed alongside new solar projects.

Figure 5

Source: Bloomberg, RBC, Baker Steel Capital Managers LLP. Date at 28 June 2024.

Lithium prices have weakened since 2022 on the back of a market surplus due to growing inventories, substantial restocking and uncertainty over EV subsidies. Signs of economic slowdown in Europe, a key EV market, and EV sales falling short of expectations have also weighed on sentiment towards lithium and lithium miners. Despite mixed recent conditions for the sector, the fundamentals for lithium remain strong, with continuously rising demand likely causing inventories to drop and prompting manufacturers to look to secure new supplies.

On the supply side, certain lithium miners are seeking more offtake agreements, strengthening cost support and reducing capital expenditure, given the recent weakness in the sector. New entrants are also deterred by current low prices. Some oversupply remains, both within China, where the supply of spodumene concentrate and other lithium resources appears sufficient, and ex-China where spodumene and salt lake brine production is expected to continue to increase.

Overall, consensus pricing implies lithium carbonate prices should rise in the years ahead with the rate of demand growth likely to outpace the supply response, as illustrated on the chart above which shows the market moving into a deficit in the years ahead. While the exact timing of a recovery for the lithium sector is unclear, the opportunity for investors is clear and highlights the benefits of active management and market timing when investing in a rapidly developing sub-sector such as this.

With regard to lithium equities, we seek those with effective cost control and healthy cash flow to maintain profitability amid sizeable potential fluctuations in lithium prices. Companies which seek to establish long-term partnerships with downstream lithium processing companies or battery manufacturers will be well-positioned, as will those with demonstrable capabilities in technological innovation to improve product quality and reduce production costs.

The clean energy transition is driving a new upcycle for critical metals and minerals

A wide range of energy sources and technologies all have a role to play in the global transition towards clean energy. From nuclear energy, which offers carbon free base-load power, to renewables such as solar, which benefit from mass-production to lower costs, the future energy mix appears likely to be varied. It is clear that in order for this transition to occur, the volumes of raw materials needed to expand clean energy production and storage, let alone transmission (see our previous report on copper), will be transformative for the producers of those commodities.

Each commodity has a unique set of market dynamics and macroeconomic drivers, resulting in significant disparities in price performance and creating substantial opportunities for those able to correctly call the moment to overweight each sector. Our focus on uranium miners within our Electrum strategy is a clear example of the value added by active asset management within the mining equity sector. Our allocation to uranium has benefitted our investors and, as per the arguments set out in this piece, we continue to see a positive outlook for the sector. Yet we are constantly seeking the next opportunities, both in the equities we select and in the sub-sectors to which we allocate. The examples we have touched upon in this piece, silver and lithium, both present sub-sectors we believe offer opportunities and value, amid the inexorable roll-out of renewable energy sources and battery technology.

We believe the metals and mining sector is at the start of a major upcycle, driven by historic demand forecasts for critical metals needed for the clean energy revolution and energy security, alongside an increasingly supportive macroeconomic environment. Mining equities show attractive valuation metrics and are in strong financial shape, while some sub-sectors of the industry such as copper miners and precious metals miners have already made strong gains this year. As the cycle turns towards recovery, history has shown that the resources sector can generate substantial returns for investors during upcycles, and that active management can significantly enhance these returns. More insights into the opportunities we see in the sector can be found here.

[i] The Guardian

[ii] Precedence Research, Baker Steel Capital Managers LLP.

[iii] UxC, Q3 2023

[iv] BMO

[v] Silver Institute.

[vi] Silver institute, BSCM forecasts

[vii] Economist, BNEF

[viii] IEA.

[ix] The Economist, “The Sun Machines”, 22 June 2024.

[x] Baker Steel forecasts, Silver Institute, BNEF

[xi] Silver Institute, Metals Focus, BNEF, Baker Steel internal research

[xii]Bloomberg. Silver miners are represented by the Global X Silver Miners ETF. Precious metals equities are represented by the MSCI ACWI Select Gold Miners Index. Data in USD terms, as at 30 June 2024.

[xiii] Precedence Research

[xiv] Rocky Mountain Institute

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.