AI and the digital infrastructure revolution – Accelerating the world’s thirst for critical metals

A plethora of metals and minerals are needed for the new industrial revolution. Can the mining industry meet demand?

Digital infrastructure is needed on a vast scale to accommodate the rapid growth of enabling technologies, from the construction of data centres for AI, to microchip manufacturing, to the installation of high-speed internet, and clean energy provision. This growth is driving a “new industrial revolution” which promises profound economic benefits as well as significant societal change, much like historical industrial revolutions from the Victorian era to the globalisation of the late-20th Century. As with previous industrial revolutions, the digital infrastructure boom will require large quantities of raw materials, alongside a historic shift towards clean energy.

The metals and mining industry is key to solving the upstream challenges facing the rollout of digital infrastructure, which requires substantial levels of raw materials at a time when supply chain challenges, geopolitical competition and concerns over ESG are growing. With many commodity prices having fallen in recent years, the mining sector now finds itself at a turning point. Mining is the missing link for the development of future technology and higher incentive prices will be needed to ensure demand can be met.

- The new industrial revolution is driving demand for raw materials – The rollout of enabling technologies, such as AI, requires a range of metals and minerals, some of which are scarce.

- Reliable zero-carbon energy is required – From renewables to nuclear, the clean energy transition is driving demand for responsibly sourced metals.

- Supply deficits for critical metals – Supply deficits for critical metals are forecast to grow amid lengthy development timelines, resource nationalism, environmental concerns, and broader supply chain challenges.

- A new upcycle for mining equities – Miners offer growth, value and yield, while macroeconomic conditions are supportive. A re-rating is due as investor sentiment turns, profitability improves, and supply deficits expand.

Critical metals – The missing link for the digital infrastructure boom

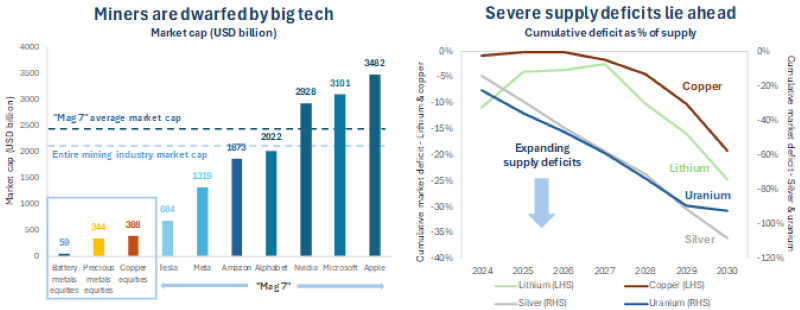

The mining sector supplies the key raw materials for future technology, from electrification to energy storage, often amid supply deficits. Despite metals such as copper, lithium and silver being crucial for the development and rollout of new technologies, miners’ valuations equate to a tiny fraction of the technology sector. The market cap of the entire copper mining industry is around USD 388 billion, while the battery metals sector is just USD 59 billion, far less than any one of the “Mag 7” technology companies, which have an average market cap of over USD 2 trillion[i].

Figure 1

Sources: Bloomberg, Benchmark Minerals Intelligence, BMO, UxC, Canaccord Genuity, RBC, Wood MacKenzie, CRU. Data at 3 September 2024.

The boom in digital infrastructure has driven an explosion in the value and economic significance of major digital technology companies in recent years. In contrast to traditional infrastructure, which requires large quantities of bulk commodities such as steel and iron ore, the new industrial revolution is driving demand for a wide range of commodities needed for electrification, decarbonisation, mobility and energy storage. Battery, speciality and precious metals stand out as sectors which are forecast to face substantial demand and sizeable supply deficits in the years ahead. As shown on the chart above, market dynamics for many of these metals are predicted to tighten significantly in the years ahead. Copper, the critical metal for electrification, faces an estimated cumulative deficit of c.19% of supply by 2030, while silver, the “unsung hero” of the green transition, faces a forecast cumulative deficit of over 100% of supply by the end of the decade[ii], driven primarily by the exponential growth of solar photovoltaic capacity, but also by further electrical applications, for example Samsung’s potential use of silver in solid-state batteries[iii].

Will AI accelerate demand for metals and minerals?

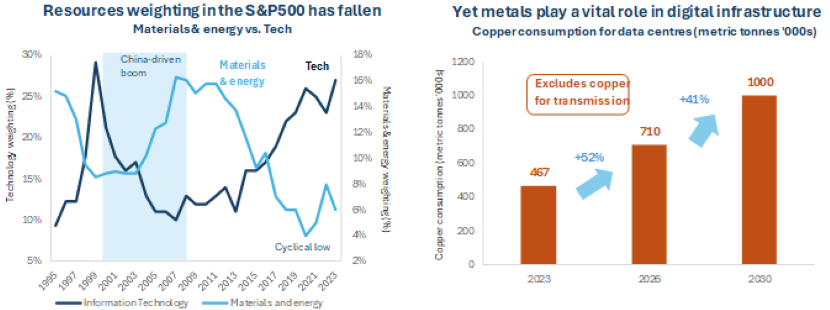

The new industrial revolution, from the development of digital infrastructure to the clean energy transition, presents the most significant driver for commodity markets and the mining sector in the years ahead. Investor sentiment towards mining equities has weakened for much of the past decade, since the end of the Chinese driven “commodity supercycle” in 2010. To put this into perspective, the chart below highlights that the weighting of materials and energy in the S&P500 collapsed from 16% in 2010 to just 4% in 2020 and has since recovered to 6%. This contrasts with technology stocks which account for 27% of the S&P500 today, compared with just 12% in 2010[iv]. This de-rating of mining equities relative to technology appears unsustainable when we consider the vital role played by metals in technological development and the construction of digital infrastructure.

Figure 2

Source: S&P, Bloomberg, AI Insight Media, Trafigura, Reuters. Data at 12 August 2024.

Copper consumption in data centres is forecast to rise +114% between 2023 and 2030, reaching 1 million metric tonnes, driven by the physical infrastructure of data centres, which include vast amounts of wiring and components that rely heavily on copper[v]. The development of AI is further accelerating demand for copper, as high-performance AI chips often require a higher intensity of copper use. For example, Nvidia’s GB200 chip requires c.86.5kg of copper per chip cabinet, which would indicate an additional 4,300 metric tonnes of copper annually based on Nvidia’s demand growth forecasts. With 48% of global data centre demand between now and 2030 anticipated to be in North America, the strategic importance of a metal such as copper seems clear[vi]. The growth of spending on digital infrastructure by technology companies is staggering. Alphabet, Amazon and Microsoft collectively invested USD 40bn during the first quarter of 2024 alone, mostly on data centres to grow AI capacity. Similarly, Meta, despite not having a cloud business, indicated that its capital expenditure could reach USD 40bn in 2024 due to AI projects, while Microsoft is likely to spend more[vii].

Government support remains key for the development of digital infrastructure, with vast quantities of both traditional and digital infrastructure projects needed to meet policymakers’ objectives on growth, energy security and decarbonisation. In the US, the Inflation Reduction Act (“IRA”) provided over USD 400bn to drive development of green technology and the semiconductor industry in the US. While many projects have been frustrated by supply chain issues, labour costs and Chinese overproduction, the IRA successfully injected momentum into the development of green technology in the US. A potential Trump victory in November may alter this momentum, yet with many clean energy projects located in Red States and with the America First doctrine prioritising US manufacturing and jobs, it is likely support for domestic raw materials production will continue in some form. Similarly in Europe, the European Critical Raw Materials Act of 2024 aims to develop a secure and sustainable supply of critical raw materials for Europe, reducing reliance on imports. European political will appears committed to the green energy transition, while European consumers account for around 25% of global new EV sales, compared with just 10% in the US and around 60% in China[viii].

China’s growth outlook and industrial strategy remains of key importance across commodity markets, particularly as policymakers become increasingly focused on cementing China’s position as a leader in high-tech manufacturing and green technology. The country’s “Made in China 2025” initiative aims to increase domestic production of core materials and high-tech products, notably semi-conductors, amid broader government support for the integration of digital technology. At the same time, export controls have been imposed on certain critical minerals. China currently produces around 80% of the world’s solar panels, compared with the United States which produces just 2%, and around two-thirds of the world’s electric vehicles, wind turbines and lithium-ion batteries[ix]. The near-monopolistic position of China in the global supply chain presents a significant strategic advantage over both the United States and other regions and highlights the scale of the challenge facing Western countries as they seek to build and expand their green energy and high-tech capacity, while establishing secure supply chains for critical raw materials.

Powering the new industrial revolution – The clean energy transition requires a sharp rise in CAPEX

The new industrial revolution will drive demand for energy as digital infrastructure expands. AI alone is forecast to add over 200twh to data centre power demand by 2030, bringing total power demand from data centres to 1,063twh, compared to 408twh in 2024[x]. In contrast to China-led industrialisation of the 2000s, the new industrial revolution favours clean energy sources over fossil fuels, driven by both private companies and government objectives. Green commitments by technology companies are among the most ambitious of any industry. Microsoft has set a target to reach net zero by 2030 and achieve carbon negative thereafter. Meta reached net zero in 2020 and support their data centres and offices with 100% renewable energy[xi]. Amazon aims to reach net-zero across all its operations, including transport for delivery, by 2040[xii].

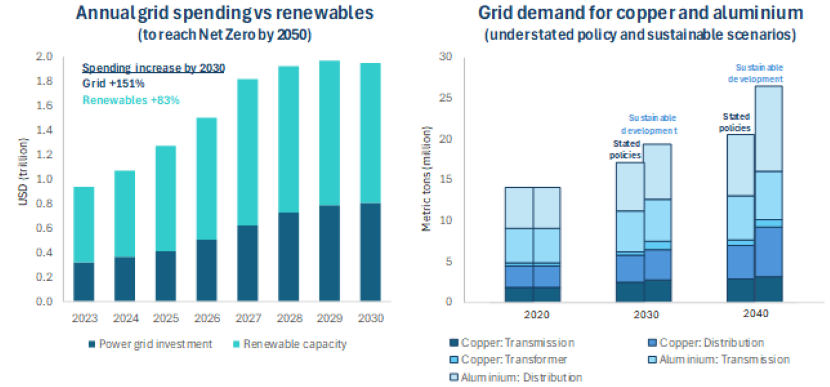

Alongside the surge in investment in renewables, there is an urgent need for investment in the electricity grid. Between 2023 and 2030 spending on renewables would need to rise 83% to stay on target for net zero by 2050, yet spending on the grid would need to rise 151%[xiii]. This demand is driven by the physical infrastructure needs of data centres which include vast amounts of wiring and components that rely heavily on copper, alongside other metals. This level of investment would have a transformational impact on metals demand, with grid demand for copper forecast to rise 53% and aluminium 29%, under the IEA’s sustainable development scenario[xiv].

Figure 3

Sources: Bloomberg NEF, IEA, The Oregon Group.

From renewable energy generation to battery storage and grid transmission, securing supply of metals and minerals is a key challenge given the intensity of use. Producing 1mw via solar energy requires 4.5t of copper, alongside 35-45t of steel and 3.5-8t aluminium. A wind turbine (1mw) requires 2-12t of copper, with amounts varying based on factors such as onshore vs. offshore, alongside 85-210t of steel, 1-2t of aluminium and c.200kg of rare earths. Meanwhile an EV requires up to 80kg of copper, around 3.5x the amount used in an internal combustion engine vehicle, along with 900kg of steel, 280kg of aluminium and c.40kg of battery metals (notably lithium and cobalt)[xv].

Renewable energy is a key element of the energy mix for the new industrial revolution, yet wind and solar do not offer the same round-the-clock power as fossil fuels. As a result, we expect nuclear energy to play an increasingly significant role as a source of baseload power. Demand for nuclear energy for digital infrastructure can be seen in the investments of technology companies in this area. In early-2024 AWS spent USD 650m on a 960MW data centre in Pennsylvania powered by a nuclear reactor. Similarly, Microsoft has struck a deal with Constellation Energy for supply of nuclear power for its data centre in Virginia, as a backstop when wind and solar are unavailable. Both firms have also been looking at the potential to utilise “small modular reactors” as the technology develops[xvi]. We are seeing a renaissance of investment in nuclear energy globally, led by China, India and Russia which are undertaking ambitious expansion programmes for their nuclear industries. Overall, around 60 reactors are under construction globally, with a further 110 planned. We examined the market dynamics and opportunities we see in the uranium sector in a recent article.

With copper, uranium, silver, lithium and many other metals facing substantial demand growth from the rollout of digital infrastructure and green energy transition, it is the supply-side for these metals which faces a challenging outlook. While AI and digitisation can bring efficiencies to the mining industry, the sector is beset by lengthy development timelines for new mines, rising resource nationalism and an increased focus on environmental concerns from investors and consumers, all of which present challenges and delays to raising production. Furthermore, the new industrial revolution is unfolding against a backdrop of deglobalization and trade nationalism, forces which favour domestic renewable energy production, for security reasons, while simultaneously disrupting supply chains through trade barriers.

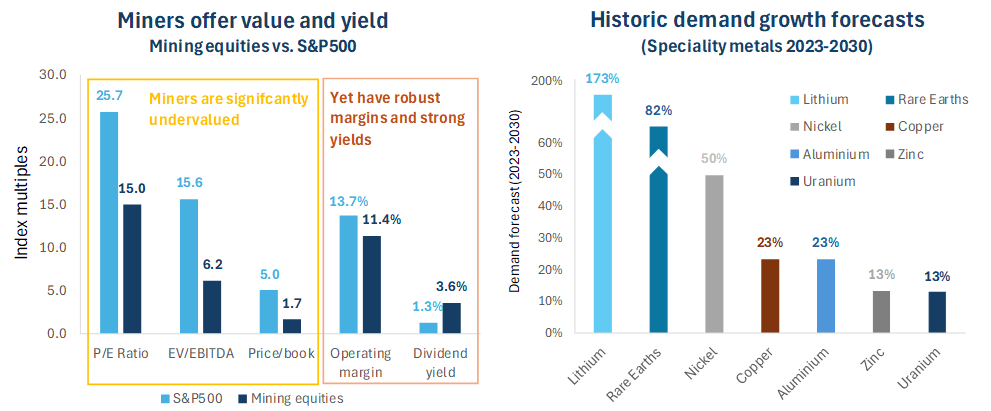

Value, growth and yield – Three reasons to hold mining equities in your portfolio

There are many reasons why mining equities will continue to attract investors’ attention, especially over the longer term. From a portfolio management perspective, miners have a relatively low correlation to US equity markets, with precious metals having the lowest correlation, offering valuable diversification. Importantly, mining equities can be considered thematic investments, offering one of the purest plays to build exposure to the growth of green technology and the clean energy transition. Fundamentally however, mining is a rare equity sector which offers value, yield and growth. The sector appears undervalued on a relative and historical basis, yet margins are largely robust and dividend yields strong relative to broader equity markets.

Figure 4

Sources: Bloomberg, Industry reports, BMO Capital Markets, Canaccord Genuity, CRU, BNEF. Data at 30 August 2024.

As highlighted in the chart above, lithium, rare earths and nickel, are key metals associated with the clean energy transition, and face demand growth forecasts of 173%, 82% and 50% respectively by 2030. Broader industrial metals with applications in future technology also face strong demand growth, with copper and aluminium both forecast to see 23% demand growth by the end of the decade[xvii]. Despite these bullish forecasts, mining equities screen as significantly undervalued across a range of valuation multiples, relative to the S&P500, with its sizeable exposure to the technology sector. Yet miners’ operating margins are strong, albeit slightly lower than the S&P500, and importantly dividend yields are substantially higher than the S&P500.

As active investment managers specialised in the metals and mining sector, we see particular opportunity in producers of selected industrial, speciality and precious metals, which face near-term deficits due to rising demand forecasts and tight supply side factors. With regard to stock selection, we favour miners which are positioned to benefit from margin expansion as commodity prices rise, through capital discipline and cost controls. We believe the recent volatility and disparities in performance between commodities make a strong case for active investment management in the mining sector and active asset allocation across sub-sectors of the industry. Each commodity has a unique set of market dynamics and macroeconomic drivers, creating substantial opportunities for those able to correctly call when to overweight each sector. While the long-term drivers for the mining sector are positive across the board, in the short-term performance can diverge, highlighting the importance of nimble asset allocation. In sectors such as lithium, where the short-term supply dynamics do not lend themselves to higher pricing, we favour producers with attractive yields, or those still profitable and generating free cash flow at depressed pricing, which offer recovery potential as the lithium market moves towards a deficit.

The years ahead will see the landscape reshaped for the metals and mining industry, given its essential role for the infrastructure needed for the new industrial revolution. Rapid digital infrastructure expansion, the development of enabling technologies and AI, and the transition towards clean energy will all continue to accelerate the world’s thirst for metals and minerals. Having been out of favour with generalist investors for several years, a range of indicators suggest miners’ fortunes may be about to change. As deficits for critical metals become acute, we expect to see rising awareness by industrial leaders of supply chain vulnerabilities. A further supportive factor for mining equities is the start of a rotation away from growth stocks towards value is highly significant for the mining sector. As the cycle turns towards recovery, history has shown that the resources sector can generate substantial returns for investors during upcycles, and that active management can significantly enhance these returns.

[i] Bloomberg.

[ii] Benchmark Minerals Intelligence, BMO, UxC, Canaccord Genuity, RBC, Wood MacKenzie, CRU.

[iii] Samsung, WhichEV.

[iv] S&P.

[v] AI Insight Media, Trafigura, Reuters.

[vi] AI Insight Media.

[vii] The Economist.

[viii] IEA.

[ix] Rio Tinto. Onshore versus Offshore wind. Framed versus frameless panels. EV requirements assume an average battery size of 55kWh (2021).

[x] The Economist.

[xi] Washington Post.

[xii] Masanet et al. (2020).

[xiii] Meta.

[xiv] Amazon UK.

[xv] Bloomberg NEF.

[xvi] IEA.

[xvii] Bloomberg, Industry reports, BMO Capital Markets, Canaccord Genuity, CRU, BNEF.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.