Can Trump make mining great again?

Macroeconomic conditions remain largely unchanged, but will Trumponomics and geopolitics drive a mining boom or bust?

The imminent return of Donald Trump to the White House has reset the tone for financial and commodities markets as we approach 2025. Having been all but written off following his 2020 defeat and subsequent legal issues, Trump’s re-election heralds a return to “America First” US policies. To an extent, Trump’s victory brings investors some clarity, given the non-contested election and Republican dominance of government, yet much policy uncertainty remains. “Trump trades” have dominated the markets since the election, boosting the US dollar, cryptocurrencies and US stock markets.

Many commodities have pulled back somewhat since the election, amid profit-taking and concerns over the pace of US interest rate cuts under Trump’s economic policies. Yet commodity markets today are backed by a range of drivers, from the structural deficits developing for many critical metals needed for energy security, digital infrastructure and high-tech manufacturing, to the historic levels of gold buying by central banks and others.

Tump 2.0 – Key opportunities for investors in metals and mining:

- Will Trump’s focus on US industrial growth boost demand for metals? – Trump 1.0 was good for metals. While a trade war may weigh on demand in the short-term, US industrial growth, reshoring of supply chains and potential new Chinese stimulus response to tariffs would be positive catalysts for the mining

- What will the future energy mix look like? – US support for renewables may weaken under Trump, yet the global push for secure, affordable, low carbon energy has momentum. Renewable energy and battery storage are inextricably linked to technological and economic development, from AI to transport, benefitting a range of metals.

- What’s next for the precious metals bull market? – The drivers of gold’s bull market appear insulated from Trump’s policies. Risk is to the upside with US interest rates on a clear downward trend despite sticky A significant rise in US debt is likely to weigh on the USD at a time of de-dollarisation across emerging markets.

- Cryptocurrencies vs. gold? – As Bitcoin hits $100k, a new generation of investors have become educated regarding the benefits of decentralised assets, with similarities to gold. However, Bitcoin’s role in a portfolio is very different to that of gold and its correlation with US equities has grown stronger in recent years. Gold is a proven safe haven asset offering uncorrelated, low volatility, returns over the long-term.

What happened to metals and mining during Trump’s first term?

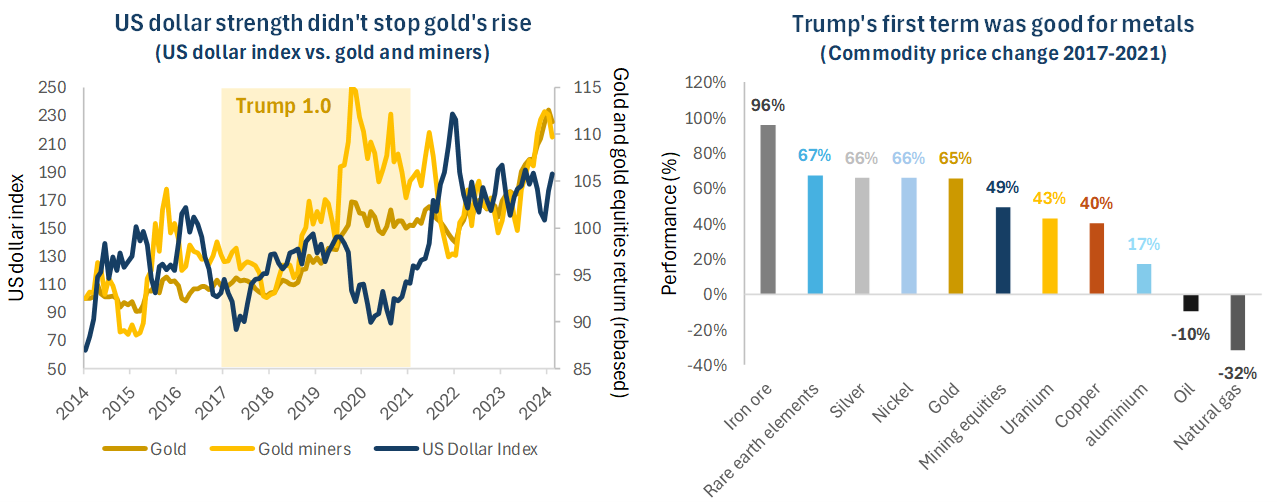

Figure 1

Source: Bloomberg. Data at 29 November 2024.

Unusually for an incoming administration, investors have recent experience of how markets behaved during Trump’s first term. As shown on the chart above, the metals and mining sector largely thrived during this period despite bouts of US dollar strength, interest rate hikes and concerns over trade war. Industrial metals such as copper, aluminium and iron ore rose strongly between 2017 and 2020, while gold and silver delivered returns similar to the S&P500. Oil and gas prices fell, as output increased. Rising metals prices and lower energy costs created a generally supportive environment for mining equities, with diversified miners rising around 49% during Trump’s presidency, and precious metals equities rising around 73%[i].

We consider the drivers for the metals and mining sector at the start Trump’s second term to be materially stronger compared to 2017. Many speciality and industrial metals face deficits in the years ahead, as metals-intensive technological growth drives demand and supply remains constrained. Meanwhile, precious metals have entered a new upcycle, backed by lower real interest rates and historic levels of demand for gold from central banks. Despite this positive outlook Trump’s victory sent the metals and mining sector into a sharp sell-off, led by precious metals, with gold retracing -6.5% and gold miners -11.2% in days following the election[ii], amid a spike in US yields. This market reaction highlights the importance of being able to differentiate between the short-term noise created by the “Trump trades” and the longer-term opportunities which a new Trump presidency offers investors. When we break down Trump’s core policy areas, we see that Trumponomics holds both opportunities and challenges for the sector, while the broader macroeconomic picture for most commodities remains unchanged.

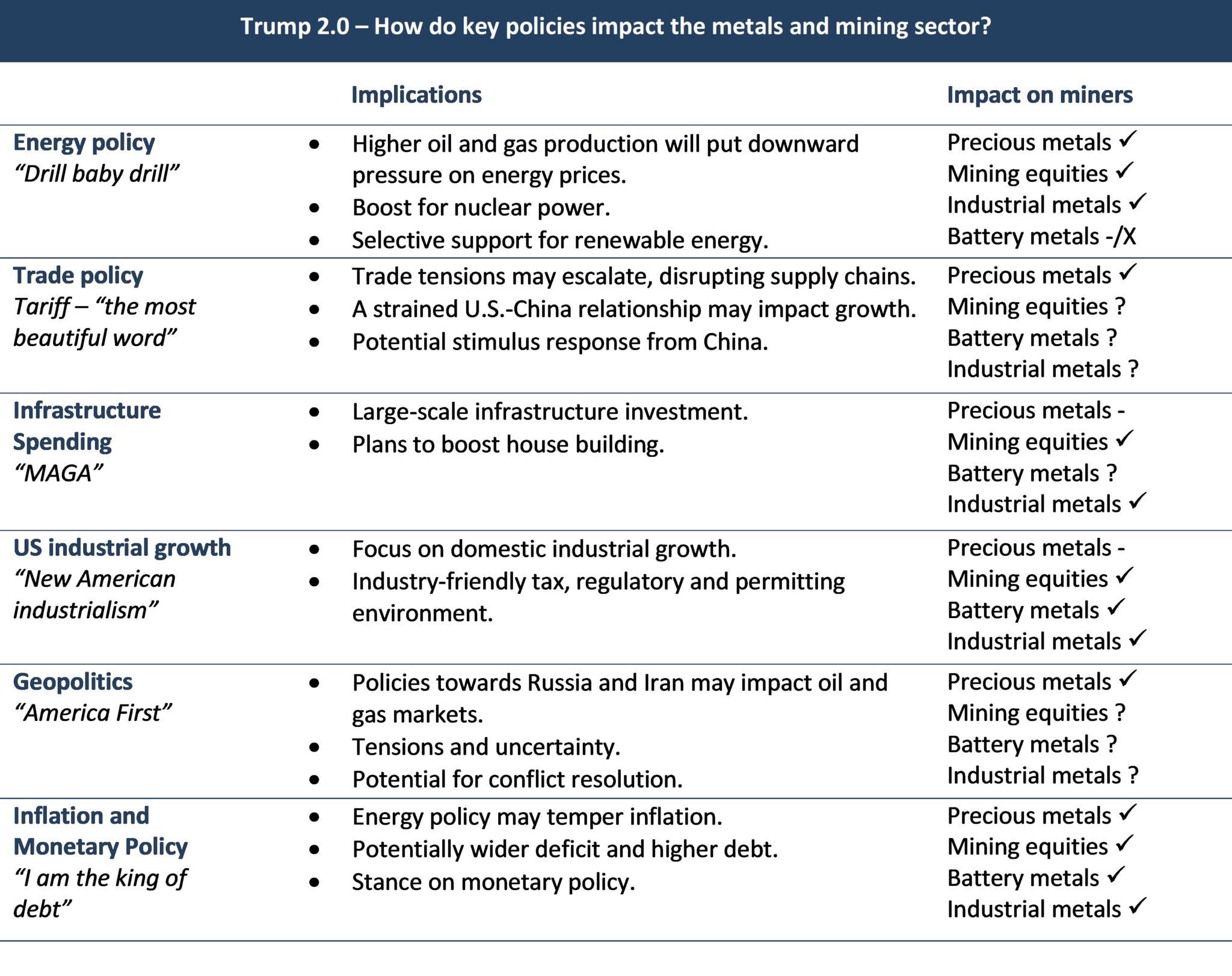

Figure 2

Source: Baker Steel Capital Managers LLP, Bloomberg.

The coming months will tell how Trump’s policies will manifest and the impact on the metals and mining sector. In the following sections we examine some of the potential outcomes for metals and mining equities.

Precious metals – Does Trump’s election change the market conditions for gold and silver?

Gold and silver performed well during Trump’s first term and the sector appears well-supported as we approach Trump 2.0. We consider that three key factors are driving the new precious metals bull market, which has seen gold rise around +45% from its October-2023 low and precious metals miners return +53% over the same period[iii]. Firstly, central banks’ buying of gold has remained strong, having hit record highs in recent years, and appears likely to continue. Asian central banks have been dominant buyers during this period, yet European central bankers are also accumulating, with the National Bank of Poland emerging as the top buyer in Q2 and Q3 of this year. Gold’s growing status as a strategic asset for central banks was highlighted earlier this year when it overtook the Euro to become the world’s second largest reserve asset. Secondly, strong physical demand from over-the counter (OTC) sources and retail demand in selected markets, notably India[iv], has continued to support gold prices.

The third, and perhaps most important, factor has been the start of a return of interest from Western investors in the gold sector, via physical gold ETFs in recent months. Q3 2024 saw gold ETFs halt their nine-quarter run of outflows, as buying by Western investors picked up sharply, alongside continued buying by Asian investors. Signs of investor interest returning in the West highlights the improving macroeconomic picture for precious metals. A key question is therefore whether Trumponomics will have significant implications for the US macroeconomic conditions, particularly the outlook for interest rates. The relation between gold price movements and the performance of US yields and the US dollar has become blurred in recent years, yet broadly it remains the case that strong upward momentum for either presents a headwind for the yellow metal.

With regard to US interest rates, inflation has proven sticky, yet we see a clear downward trend. While the pace of rate cuts may face uncertainty in 2025, overall falling rates tend to be a highly supportive factor for metals and mining. Overall, the President Elect makes no secret of his desire to see a weaker dollar and lower interest rates. Having expressed disapproval of Jerome Powell’s hawkish stance, we can be sure that Trump will do all he can to encourage doveish policy. It is worth remembering that during Trump’s first term he nominated Judy Shelton, a prominent advocate of the gold standard, to fill a seat on the Federal Reserve’s Board of Governors. Investors’ expectations for a slower rate cutting cycle under Trump may prove unfounded. Having been elected on the back of public anger over inflation, and with an energy policy aimed at keeping consumers’ energy costs low, we anticipate that US interest rates will continue to fall, albeit with less certainty in the near-term. Hard assets, most notably precious metals, appear poised to benefit under these conditions. Furthermore, if Trump’s policies are successful in driving stronger economic growth (potentially with some inflation) we consider this would be highly supportive for selected metal producers.

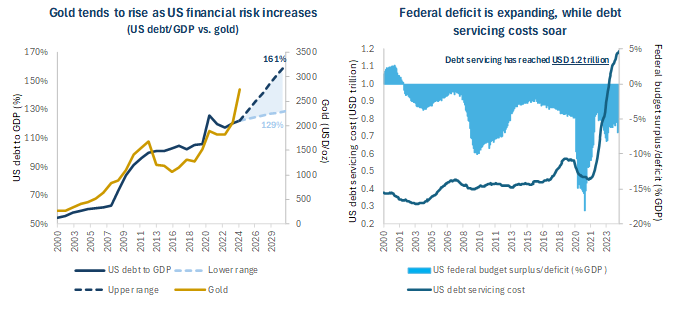

Figure 3

Source: Bloomberg, Committee for a Responsible Federal Budget.

With regard to the outlook for the US dollar, while it may face further strength in the short-term, we believe the reality of rising debt levels and debt servicing, combined with a fiscal deficit and a less hawkish rate environment, will put downward pressure on the currency over time. Debt projections are significantly higher under Trump’s proposed policies, in contrast to the Democratic alternative, with debt-to GDP indicated to expand to 143% over the coming decade, potentially hitting 161% under a high-cost scenario[v]. While the new Department of Government Efficiency (“DOGE”) headed by Elon Musk and Vivek Ramaswamy may have some limited impact on government finances, the significant deterioration in the US financial position is clear. Debt servicing costs have ballooned in recent years, amid rising debt levels and higher interest rates, reaching an annual cost of around USD 1.2 trillion in 2024, compared to USD 500 billion at the end of 2021[vi]. These challenges come at a time of de-dollarisation across emerging markets. China has decreased its US treasury holdings by 11% since the start of 2022, while increasing its gold holdings by around 13% over the same period[vii]. While the trend of de-dollarisation has been underway for some time, we consider that Trump’s confrontational approach to international relations is likely to accelerate this trend.

Trade, growth and energy policies – A demand boom for metals in the US?

Trump’s re-election brings much uncertainty for trade and, by extension, much uncertainty for commodity markets. While Trump initially floated imposing a 10%/20% baseline tariff on all imports, and as much as 60% on Chinese imports, the likely impact will be a rise in the aggregate US weighted tariff by 5% points, from c.3% currently to 8% by end of 2026[viii]. China will be bearing the brunt of that increase. Trump’s heavy-handed rhetoric adds an element of unpredictability to his policies, such as his vow during November to impose 25% tariffs on imports from Canada and Mexico, and an extra 10% on China goods. A further threat in the run-up to the election was to impose “100% tariffs” on the BRICS, a group of nine developing nations, if they create a rival currency to the US dollar, suggesting heightened volatility in FX markets ahead.

We view Trump’s ongoing tariffs-talk as an anchoring technique to change market expectations, yet undoubtedly this environment indicates risks (and opportunities) for commodity markets in the short-term. Trade wars tend to impact growth and hence reduce commodity demand, yet the geopolitically charged nature of US-China trade confrontation increases the chance that punitive tariffs by the US would provoke retaliation by the Chinese in the form of stimulus. Chinese policymakers are already indicating “more proactive” fiscal stimulus alongside a “moderately loose” monetary policy, which would likely be supportive for metals and miners[ix]. Furthermore, if Trump’s America First policies are successful in stoking industrial growth in the US, this would undoubtedly be positive for industrial metals producers. Miners based in and operating in the US would stand to benefit the most from policies favouring increasing domestic production and onshoring of supply chains.

Importantly for investors in metals and mining, the most significant driver of demand, the new industrial revolution, is unlikely to be impacted by Trump’s policies. Rapid growth across a range of technologies with a high intensity of use of metals is set to continue, from the construction of data centres and the rollout of AI to the inexorable rise of clean energy.

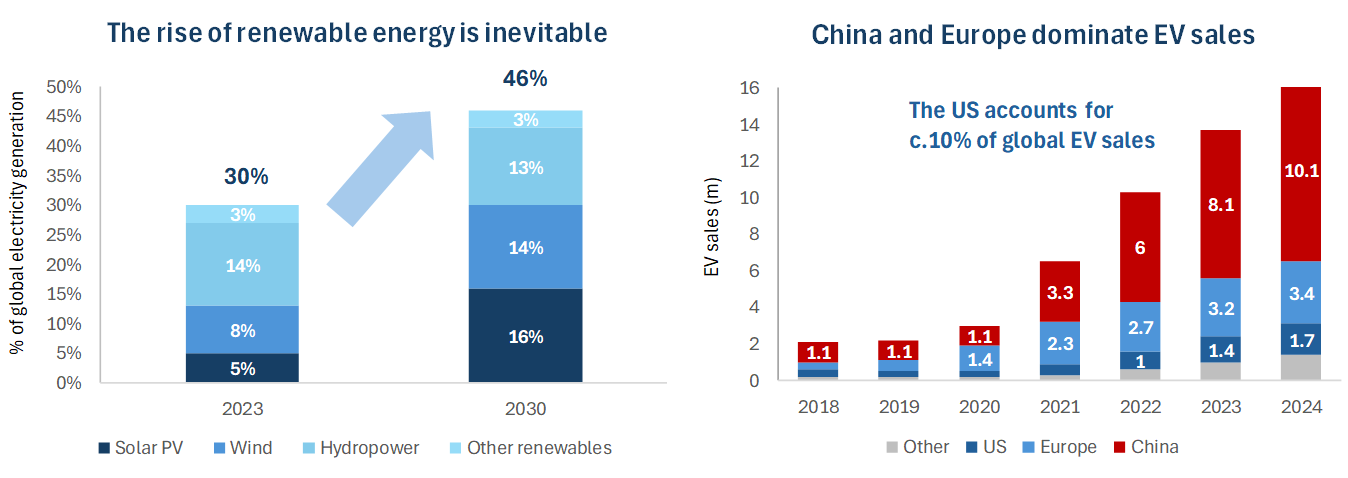

Figure 4

Source: IEA Renewables 2024 Global Overview, IEA Global EV Outlook 2024.

Trump’s scepticism regarding climate change is well-known and one of his high-profile policies is to reduce support for development of clean energy under the 2022 Inflation Reduction Act (IRA). While cuts to subsidies may imply reduced demand for certain commodities used in clean energy technology, notably battery metals, we consider that the transition towards clean energy has strong momentum, with USD 115b having been spent already under the IRA. Renewable electricity generation is forecast to rise almost 90% from 2023 to 2030 globally, while renewables-based electricity generation is forecast to overtake coal-fired power in 2025. Furthermore, renewable energy is forecast to account for 46% of global electricity generation by the end of this decade, from around 30% at present[x]. This changing energy mix has a significant impact on the demand outlook for metals from copper and aluminium for electric infrastructure, to lithium and nickel for battery storage capacity, to silver for the production of solar photovoltaic cells. Energy demand will continue to grow as technological development progresses. The growth of cryptocurrencies exemplifies this, with Bitcoin currently estimated to consume around 175TWh annually, equivalent to the energy consumption of Poland[xi].

Alongside increasing renewable capacity, the growth of nuclear energy is also likely to continue and possibly accelerate under Trump, as technology companies make significant investments in this area. AWS and Microsoft have both invested in securing nuclear power for data centres in Pennsylvania and Virginia, utilising small modular reactors (“SMR”) as the technology develops[xii]. With AI forecast to require an additional >200TWh of power for data centres by 2030, we consider that major technology companies will continue to seek nuclear sources alongside renewables. The US will account for nearly 26% of global uranium consumption in 2026 and we expect the uranium price to rise, as Trump threatens a 25% tariff on imports from Canada and following the Russian ban of enriched uranium exports to the US. The US will need to expand domestic production and boost reserve stocks to reduce reliance on other countries for its nuclear fuel.

A full repeal of the IRA by Trump appears unlikely, particularly given 80% of investments have been made in Red States, yet sectors such as electric vehicles (EV) will likely be impacted by the removal of tax credit, impacting domestic EV manufacturers. Elon Musk, Trump’s key backer during the election campaign, reportedly supports the removal of the USD 7500 credit for EV purchases, reasoning that it will deter foreign competition, even if it does slow EV penetration in the US. An industrialist who is pro-mining and pro-efficiency, Musk’s influence on Trump’s policies could prove beneficial for western critical minerals producers, having highlighted concern about the supply of metals like lithium, nickel, and copper. In fact, Musk has commented in recent years that Tesla would buy mining companies and projects, if that was the most viable path to accelerate the transition[xiii].

Figure 5

Source: USGS.

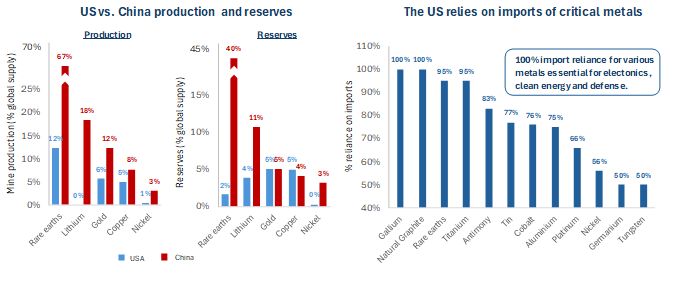

Given policymakers’ increased concern regarding China’s economic challenge to the US today, compared with Trump’s first term, we can expect that Trump 2.0 may want to reduce vulnerabilities within supply chains which are dependent on foreign nations. China dominates production of solar, rare-earth, batteries and wind turbines, while US clean energy firms have relied heavily on IRA tax incentives and government support to sustain operations. As highlighted on the chart above, the US is 100% import reliant for various metals, including rare earths and other metals which are essential for electronics, clean energy and defence. Out of the 50 minerals deemed critical by the US government, the US is 100% reliant on imports for 12 of them, and over 50% reliant for another 31 critical minerals[xiv]. Highlighting the severity of these supply issues, this month China banned exports to the US of gallium, germanium and antimony, which have widespread military applications, escalating trade tensions in response to the US’s crackdown on China’s chip sector[xv].

While supply side challenges are likely to be exacerbated by trade tensions and tariffs, the opportunity for domestic miners is significant. A focus on domestic production, industrial growth, expedited permitting and reduced environmental regulation sets a highly supportive tone for the US mining sector. Furthermore, Trump’s focus on increasing US oil production implies that energy costs for miners should remain under control. These factors should prove supportive for the US mining sector, which currently faces long lead times for developing critical mineral mining projects, taking an average of 29 years from discovery to production[xvi]. Ultimately, while the Trump administration’s focus on fossil fuels and opposition to the IRA funding creates a complex outlook for the critical minerals sector, we believe a combination of technological development, efforts to boost industrial growth and supply chain challenges indicates substantial opportunities for selected sub-sectors of the mining industry in the years ahead.

Uncertainty remains, yet Trumponomics holds risks and opportunities for miners

The coming months may see continued volatility in the metals and mining sector, however investors who can see past the short-termism of the “Trump trades” will appreciate that Trump’s victory does not materially change the macroeconomic outlook for the metals and mining sector, while offering benefits for US-based miners. Trump’s pro-growth policies, from lower taxes to deregulation and expansionary fiscal policy, are positive factors for producers of industrial and selected speciality metals, while deteriorating public finances and uncertainty over trade confrontation will likely add to the precious metals sector’s current momentum. The macroeconomic backdrop of sticky yet stable inflation and lower interest rates in the US, coupled with growing challenges to the US dollar’s dominance across emerging markets, appears likely to continue to provide a supportive environment for metals and mining, particularly precious metals.

We consider that the metals and mining industry is on the cusp of a new upcycle, given the essential industrial and strategic role of metals and minerals in the development of new technologies and in energy security. As the new industrial revolution accelerates the world’s thirst for metals and minerals needed for digital infrastructure expansion, AI, transport and the transition towards clean energy, the US’s reliance on imports of critical metals and minerals is becoming increasingly concerning. We believe this theme will continue to grow in significance during Trump 2.0, to the benefit of US-based producers of critical metals.

As active investment managers specialised in the metals and mining sector, we see particular opportunity in producers of selected industrial, speciality and precious metals, which face near-term deficits due to rising demand forecasts and tight supply side factors. With regard to stock selection, we favour miners which are positioned to benefit from margin expansion as commodity prices rise, through capital discipline and cost controls. As in previous cycles, we believe active investment management in the natural resources sector can generate substantial potential returns for investors.

[i] Mining equities represented by the MSCI ACWI Metals and Mining Index, precious metals equities represented by the MSCI ACWI Select Metals and Mining Index. In USD terms.

[ii] Bloomberg. Date range 5/11/24 to 14/11/24. Data in USD terms.

[iii] Bloomberg. Date range 4/10/23 to 29/11/24. Data in USD terms.

[iv] World Gold Council, Q3 2024 Demand Trends.

[v] Committee for a Responsible Federal Budget.

[vi] Bloomberg, data at 31 October 2024.

[vii] Bloomberg. Data at 30 September 2024.

[viii] Bloomberg.

[ix] Boomberg.

[x] IEA Renewables 2024 Global Overview.

[xi] Bitcoin Energy Consumption Index.

[xii] The Economist.

[xiii] FT Future of the Car 2022 conference.

[xiv] Visual capitalist, USGS.

[xv] Reuters, Bloomberg.

[xvi] S&P Global report, “Mine development times: The US in perspective”.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.