Will miners unearth riches for investors in 2025?

From the metals-intensive technologies of the new industrial revolution to the macroeconomic forces driving precious metals demand, the mining sector has never been more relevant for investors.

2024 was a conspicuous year for the metals and mining sector as commodity prices and mining equities were buffeted by both economic and political forces; from central bank policy and economic growth concerns to supply disruption and conflict escalation around the world. A defining theme of the past year was the stark divergence in the fortunes of different metals, from gold and silver which entered a substantial new bull market phase, to battery metals which remained under pressure. 2024 clearly demonstrated the need for an active management approach to adjust for short-term commodity market dynamics, such as supply shocks, while maintaining exposure to longer-term secular demand trends. The outlook for commodity markets is strong at the start of 2025, shaped by a mix of geopolitical and economic developments, supply chain dynamics, sustainability factors and technological advancements. Dominant themes for investors include:

- The new industrial revolution – From AI datacentres and digital infrastructure to the expansion of clean energy capacity, battery technology and electric vehicles (EVs), metals-intensive industries are driving demand for critical metals and minerals.

- Geopolitics creates opportunities and risks – The start of Trump 2.0, rising great power competition between the US and China, and volatile conflicts in Ukraine and the Middle East will dominate investor interest in 2025. Supply chain disruption and competition for critical natural resources is a growing theme.

- Macroeconomics will continue to drive sentiment – The outlook for US inflation, economic activity and interest rate direction will remain influential for the metals and mining sector, as will the outlook for Chinese growth and potential stimulus measures. The balance of risk and reward for commodities is skewed to the upside.

- What next for miners? – A selection of miners performed well in 2024 but have yet to deliver anything like the potential returns seen in previous cycles. Mining equities remain deeply undervalued on a fundamental and a relative basis, as the market has yet to appreciate the sector’s financial health and growth outlook.

- Global equity markets valuations – The Mag 7 and crypto continue to dominate investors’ attention. Yet, for contrarians seeking a heavily undervalued sector with strong growth, attractive yield potential and robust supply and demand fundamentals, the mining sector has never looked more attractive.

Metals and miners in 2025 – An oversold sector?

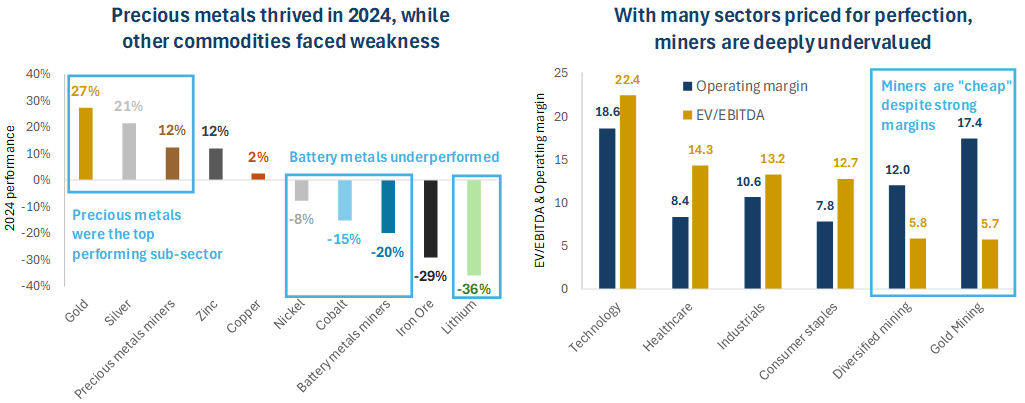

Figure 1

Sources: Bloomberg. Data at 31 December 2024.

Looking back to the start of 2024 we highlighted the strong outlook for the precious metals sector, based on supportive market and macroeconomic conditions (which we continue to see). Gold and silver were among the top performing commodities in 2024, while precious metals miners delivered respectable returns. The magnitude of gold’s rise during the year has demonstrated the strength of the drivers behind demand for the metal; from central banks building their gold reserves to signs of institutional buying and strong retail demand in certain markets, gold’s allure as a safe-haven asset, real asset and portfolio diversifier appears to be strengthening.

Across the broader metals and mining sector, 2024 saw bright spots such as the copper price exceeding USD 10,000/t during May. Certain other industrial metals also thrived, notably aluminium which gained around 14% (in USD terms) during the year amid a tightening market balance on the back of strong global demand growth. In contrast, battery metals faced another year of weak performance, with lithium, nickel and cobalt facing price declines and battery metals miners significantly underperforming the broader mining sector. Yet, as we will address later in this piece, the battery metals sector’s weakness belies the significant demand trends for critical metals and minerals needed for the energy transition.

In terms of valuation, as highlighted on the chart above, mining equities are currently trading at EV/EBTIDA multiples far below most other equity sectors, but are delivering higher or similar operating margins. With the Magnificent 7 and cryptocurrencies dominating investors’ attention at the start of 2025, contrarian investors seeking a deeply undervalued sector with strong growth and fundamentals may find the mining sector has never looked more attractive.

Growth, trade and the New Industrial Revolution – What’s next for speciality and industrial metals?

The mining sector begins 2025 backed by supportive long-term demand trends, yet investors face uncertainty over economic growth policies, both in the US and China, as well as geopolitical tension and ongoing conflicts. In the following section we address three areas of focus for industrial and speciality metals miners –

- Supply deficits for critical metals are forecast to deepen in the years ahead as technological development, the rollout of digital infrastructure and clean energy transition drive growth, and limited new supply.

- Trump 2.0 brings opportunities and risks for miners, as pro-growth domestic policies conflict with the threat of tariffs and repeal of green legislation.

- Impending Chinese economic stimulus to boost growth and counter US tariffs would be a significant positive catalyst for metals and mining.

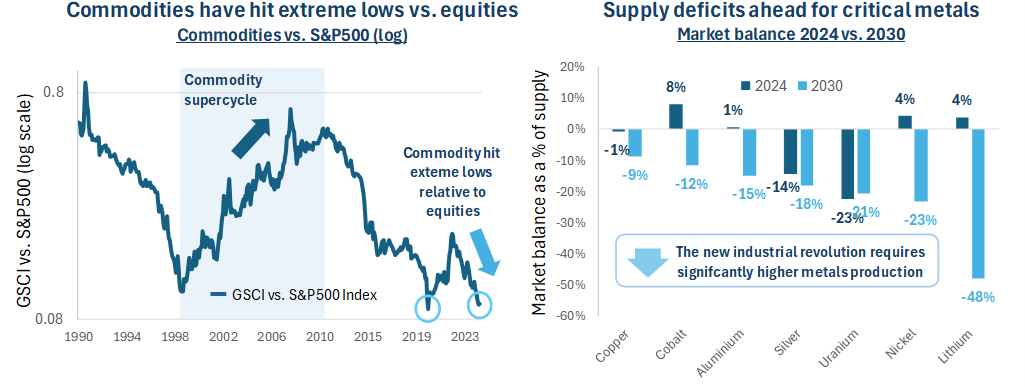

Our first area of focus for the metals and mining sector is the unprecedented secular growth trend driven by technological development, from the rollout of digital infrastructure and the development of AI to the clean energy transition, energy security and battery storage. Collectively, these technologies can be characterised as the “New Industrial Revolution”. With commodities market valuations having hit extreme lows relative to equities markets we consider a turning point is near, as soaring demand forecasts for critical metals drive supply deficits.

Figure 2

Sources: IEA, CRU, Wood Mackenzie, Benchmark Mineral Intelligence, Bloomberg, BNEF, Baker Steel Capital Managers LLP. Note, 2030 supply deficit forecasts based on IEA net zero scenario.

Growing supply deficits, from industrial metals to battery metals, are a significant driver for the metals and mining sector’s recovery. On the industrial side, the copper and aluminium markets will both transition from a small surplus in 2024 to deficits equating to -9% and -15% of supply respectively by the end of the decade[i]. Copper provides a good example of how commodities face individual market dynamics. Long-term demand for copper is being driven by technological growth, as the indispensable commodity required for electrification, from EVs to renewable energy production, transmission and storage. Demand is expected to rise by around 19% between 2024 and 2030, with particularly notable growth areas such as AI datacentres. Unexpected supply issues for the copper market during 2024 resulted in a squeeze on the copper market mid-year, which benefitted active investors such as Baker Steel. The copper market faces a deficit as mine production will be in steady decline from 2027 onwards[ii], amid supply challenges such as longer permitting timelines and growing environmental scrutiny. It can easily take a decade, and often much longer, for a copper discovery to become an operating mine. Higher incentive prices are needed for copper miners to meet rising copper demand.

Turning to battery metals miners, this sub-sector has faced weakness in recent years, with prices of lithium, nickel and cobalt having fallen -86%, -69% and -70% respectively since their highs in 2022[iii]. To take the example of lithium, prices have weakened on the back of a market surplus due to growing inventories, substantial restocking and uncertainty over EV subsidies. Signs of economic slowdown in Europe, a key EV market, and EV sales below expectations have also weighed on sentiment, despite a pickup in hybrid vehicle sales. Ultimately, electrification of transport appears inevitable and the fundamentals for lithium remain strong, with continuously rising demand likely causing inventories to drop and prompting manufacturers to look to secure new supplies. Consensus pricing implies lithium carbonate prices should rise in the years ahead with the rate of demand growth likely to outpace the supply response, with the market moving into a deficit in the years ahead.

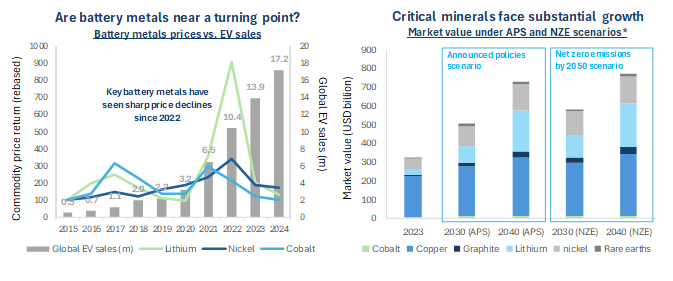

Figure 3

Sources: Economist, Bloomberg, BNEF, Baker Steel Capital Managers LLP, IEA. *Announced Pledges Scenario (APS) and Net Zero Emissions by 2050 Scenario (NZE).

In our view the battery metals sector’s current weakness represents a substantial opportunity for investors. Forecasts from the International Energy Agency (IEA) indicate significant growth for these markets by the end of this decade, with the lithium market value expected to expand by almost 700% over the next 15 years based on announced pledges, while the cobalt and nickel sectors face forecast growth of 114% and 152% respectively over this period[iv]. Under the IEA’s net zero scenario, the growth for these metals would increase further. While political enthusiasm for net zero policies has waned somewhat in the US and parts of Europe, the progress and momentum since the Inflation Reduction Act (IRA) of 2022 has been remarkable. EV rollout has strong momentum, with sales estimated to have risen 26% in 2024 to a total of 17.2 million units, higher than expected as strong gains in Asia offset a drop in sales in Europe. EVs now account for around half of all vehicle sales in China, just under a third of sales in Europe, and 11% in the US[v].

Global demand for energy generation and storage is soaring, exacerbated by the fast growth of technologies such as AI and cryptocurrencies. Global power demand at data centres is forecast to jump from 240twh in 2020 to 600twh in 2025[vi]. Meanwhile, Bitcoin is currently estimated to consume around 175twh annually, equivalent to the energy consumption of Poland[vii]. With leading technology companies having committed to strict climate goals and net-zero targets, renewable energy capacity must increase significantly. With lithium-ion battery prices falling the IEA predicts that 2025 will be the year that solar power will become cheaper than the coal-fired power in China and new gas-fired plants in America, a significant milestone. Furthermore, as addressed in our recent article on the uranium sector we believe nuclear energy, which offers carbon free base-load power, also has a role to play alongside renewables sources such as solar, to ensure power is provided round the clock.

Turning to our second area of focus, the imminent return of Donald Trump to the White House raises questions of how “America First” trade policies and the potential repeal of climate-friendly legislation may alter the outlook for the metals and mining sector. Importantly, Trump’s first term was a positive period for metals prices and as outlined in our recent article Can Trump make mining great again? we believe Trump’s second term holds significant promise for the mining sector in the years ahead. Trump’s pro-growth US industrial policies, support for housing and infrastructure, and focus on domestic growth and energy production are all positive drivers for the mining sector, countering the risk that tariffs weigh on demand for certain commodities in the short-term. If Trump’s policies are successful in stoking industrial growth in the US, this would be a significant demand driver for industrial metals producers. Supply side challenges are likely to be exacerbated by trade tensions, yet the opportunity for domestic miners is significant. Alongside an increased focus on domestic production, mining companies operating in the US stand to benefit from expedited permitting and reduced environmental regulation. Furthermore, Trump’s focus on increasing US oil production implies that energy costs for miners should remain under control. US support for renewables may weaken under Trump, yet as addressed above, the global push for secure, affordable, low carbon energy has strong momentum.

A full repeal of the IRA by Trump is unlikely given 80% of investments have been made in Red States[viii], yet sectors such as EVs will likely be impacted by the removal of tax credits. Elon Musk, Trump’s key backer during the election campaign, reportedly supports the removal of tax credits, reasoning that it will deter foreign competition, even if it does slow EV penetration in the US. An industrialist who is pro-mining and pro-efficiency, Musk’s influence on Trump’s policies could prove beneficial for western critical minerals producers, having highlighted concern about the supply of metals like lithium, nickel, and copper. In fact, Musk has commented in recent years that Tesla would buy mining companies and projects, if that was the most viable path to accelerate the transition[ix].

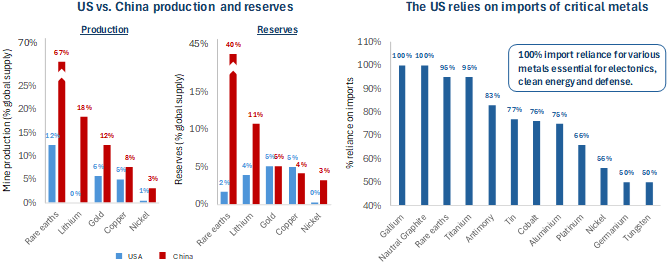

Figure 4

Source: USGS.

As highlighted on the chart above, the US is 100% import reliant for various metals, including rare earths and other metals which are essential for electronics, clean energy and defence. Given policymakers’ increased concern regarding China’s economic challenge to the US today, compared with Trump’s first term, we can expect that Trump 2.0 may want to reduce vulnerabilities within supply chains which are dependent on foreign nations.

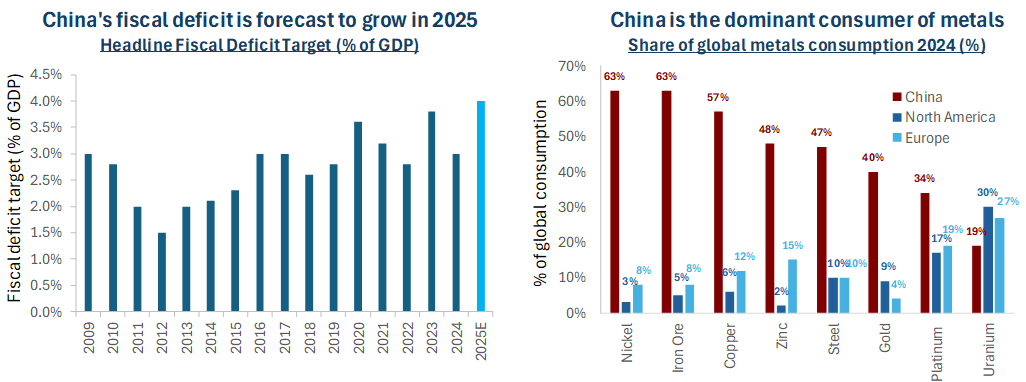

China’s influence in commodity markets bring us to our third key topic for investors at the start of 2025; the potential for new Chinese economic stimulus. The country is grappling with the fallout from a property crash and potential renewed trade war with the US, threatening to drag growth below 5% in 2025. The need to stimulate domestic demand is acute, with Chinese households’ savings now 32% higher than pre-COVID, equating to 54% of nominal GDP, and with borrowing 15% lower[x]. PBoC stimulus in 2024 was intended to encourage investment into domestic risk assets, primarily equity and property, and we expect stimulus to continue during 2025 and 2026 until Chinese equity and property prices bounce back.

Figure 5

Sources: China Government Releases, Bloomberg.

Economic support is expected to drive China’s fiscal deficit to new highs in 2025. As the largest consumer of commodities globally, new Chinese stimulus will potentially deliver a significant boost to commodity markets. Previous major economic support packages, most notably the aggressive rate cuts and stimulus spending in 2020 and 2008 respectively, fuelled rallies across the metals and mining sector. While the timing and magnitude of Chinese stimulus is unclear, it is likely that the PBoC will continue to reduce interest rates and reserve requirement ratios (“RRR”) for banks in 2025 while increasing easing policies such as purchasing government bonds and conducting outright reverse repurchase operations. It is significant that policymakers have shifted China’s monetary policy stance from “prudent” to “expansionary” for the first time since 2010, with the expressed goal of stabilising stock and property markets and “vigorously” stimulating domestic consumption. In our view the geopolitically charged nature of the US-China trade confrontation increases the chance of major stimulus, benefitting the metals and mining sector amid a boost to domestic consumption and growth.

Precious metals – As gold and silver move higher, will miners deliver?

Gold starts 2025 with momentum, backed by a number of drivers including central bank buying and selectively strong retail and institutional demand for bullion. Silver is also well-supported by tight market dynamics, with the physical market in a supply deficit, and by strong industrial demand forecasts, notably from solar energy. Precious metals’ strong performance in 2024 reflects these tailwinds, however gold and silver miners have yet to deliver the magnitude of returns seen in previous bull markets. As we consider whether miners will deliver in 2025, key themes include –

- Strong demand trends for gold appear likely to continue, with China having re-started gold purchases in Q4 2024 and with numerous economic and geopolitical risks driving demand for safe haven assets in 2025.

- The macroeconomic backdrop is supportive for precious metals, with interest rates on a downward trajectory, despite the Fed’s cautious tone, and inflation remaining sticky.

- Gold’s bull market appears insulated from Trump’s trade policies, while a rise in US debt and deficit at a time of de-dollarisation across emerging markets would likely benefit precious metals.

- Precious metals miners appear deeply undervalued on a relative and historic basis. We see strong upside potential with miners poised to re-rate, as margins expand and shareholder returns increase.

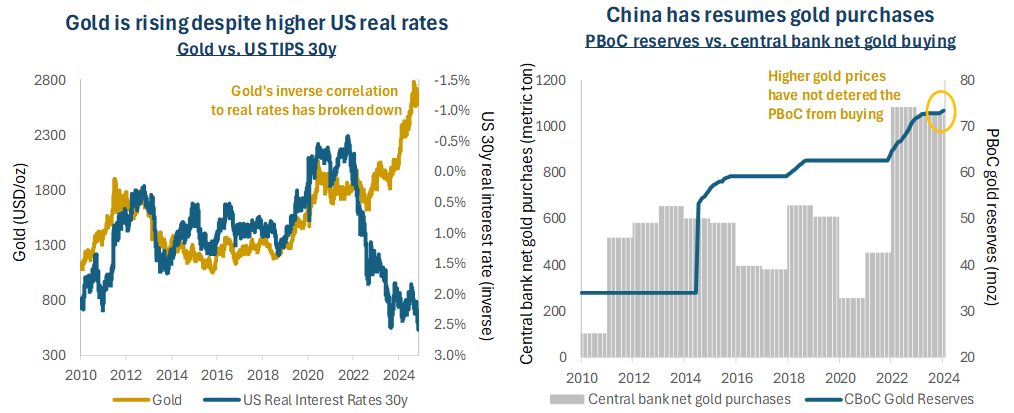

Strong demand trends pushed the gold price to new highs in 2024, and the metal appears set to continue its ascent in 2025. Of the core market segments for gold, retail, institutional and central banks, it has been central bankers’ accumulation of gold which has been touted as the key demand growth area in recent years. Having hit record highs in 2022 and 2023, central banks’ buying of gold remained strong in 2024, with Asian central banks being among the dominant buyers, alongside certain European central banks, notably the National Bank of Poland which emerged as the top buyer in Q2 and Q3 of this year. Gold overtook the Euro to become the world’s second largest reserve asset earlier this year[xi]. Higher gold prices have not deterred central bank buying, as shown on the right-hand chart below which highlights that the PBoC resumed buying gold in November 2024, having paused its purchasing in May 2024.

Figure 6

Sources: Bloomberg. Data as at 10 January 2025.

Strong physical gold demand from over-the counter (OTC) sources and retail demand in selected markets, notably India[xii], has continued to support gold prices. Meanwhile Western institutional demand for gold, which picked up in Q3 2024, remains largely driven by market conditions and the macroeconomic environment. Despite gold’s strong performance in 2024, institutional interest in the sector is only just showing signs of improvement. In our view, a core reason for this indifference has been the competition from other asset classes, notably US technology stocks and cryptocurrencies. Soaring US equity markets have been driven ever higher on the promise of AI, limiting investors’ appetite to seek value and diversification. Meanwhile with Bitcoin having hit USD 100k, a new generation of investors have become educated regarding the benefits of decentralised assets, with similarities to gold. However, Bitcoin’s role in a portfolio is very different to that of gold and its correlation with US equities has grown stronger in recent years. Gold is a proven safe haven asset offering uncorrelated, low volatility, returns over the long-term. In our view there is a strong chance that gold demand may be boosted following crypto’s recent rally, as investors take profits and seek to invest into other assets with no counterparty risk.

The macroeconomic environment for precious metals remains supportive at the start of 2025. US interest rates are on a clear downward trend, while inflation has proven sticky. The pace of rate cuts by the US Fed may face uncertainty in 2025, yet overall falling rates tend to be a highly supportive factor for metals and mining. Importantly, gold has delivered strong returns despite higher yields in recent years, blurring the typical inverse relationship, as shown on the left-hand chart above. In our view this demonstrates the strength of the demand drivers for gold and the “reset” of gold prices into a higher trading range. As financial markets prepare for Trump 2.0, we consider that gold’s bull market appears largely insulated from the impact of Trumponomics, with risk to the upside. The President Elect makes no secret of his desire to see a weaker dollar and lower interest rates. Having publicly disagreed with Jerome Powell’s hawkish stance, it is likely Trump will do all he can to encourage doveish monetary policy. Potentially Trump could seek to replace Powell with a loyalist when his term ends in May 2026. Notably during Trump’s first term he nominated Judy Shelton, a prominent advocate of the gold standard, to fill a seat on the US Fed’s Board of Governors. Undoubtedly, speculation over the pace of the US Fed’s rate cutting cycle will continue. Having been elected on the back of public anger over inflation, and with an energy policy aimed at keeping consumers’ energy costs low, we anticipate that US interest rates will continue to fall under Trump, albeit with less certainty in the near-term.

With regard to the outlook for the US dollar, despite short-term strength we believe the reality of rising debt levels and debt servicing, combined with a fiscal deficit and a less hawkish rate environment, will put downward pressure on the currency over time. Debt projections under Trump’s proposed policies indicate debt-to GDP will hit 143% over the coming decade, potentially rising to 161% under a high-cost scenario[xiii]. While the new Department of Government Efficiency (“DOGE”) may have some limited impact on government finances, the deterioration in the US financial position is clear. US public debt servicing costs ballooned to around USD 1.2 trillion in 2024, compared to USD 500 billion at the end of 2021[xiv]. These challenges come at a time of de-dollarisation across emerging markets. China has decreased its US treasury holdings by 11% since the start of 2022, while increasing its gold holdings by around 13% over the same period[xv]. While the trend of de-dollarisation has been underway for some time, we consider that Trump’s confrontational approach to international relations is likely to accelerate this trend. An array of demand drivers suggest that gold’s bull market has further to run, creating a positive backdrop for precious metals miners to deliver strong performance in 2025.

Silver and platinum group metals (“PGMs”) likewise face supportive market conditions and strong fundamentals going into 2025. The silver market is currently in a supply deficit, which is forecast to grow to 18% of supply by 2030[xvi]. As a precious metal, silver faces similar macroeconomic drivers as gold, such as concerns over unsustainable government debt, de-dollarization and inflation. Silver is also a key industrial metal, which faces substantial growth potential from the rapid expansion of solar photovoltaic capacity, and from further electrical applications, for example Samsung’s potential use of silver in solid-state batteries[xvii]. While gold is trading near all-time highs, silver remains significantly below its all-time highs, yet during precious metals upcycles, silver has tended to outperform gold significantly. Meanwhile the PGM sector is facing its third consecutive year of supply deficit in 2025, with demand boosted from a pickup in hybrid vehicle sales and mine supply remaining constrained[xviii].

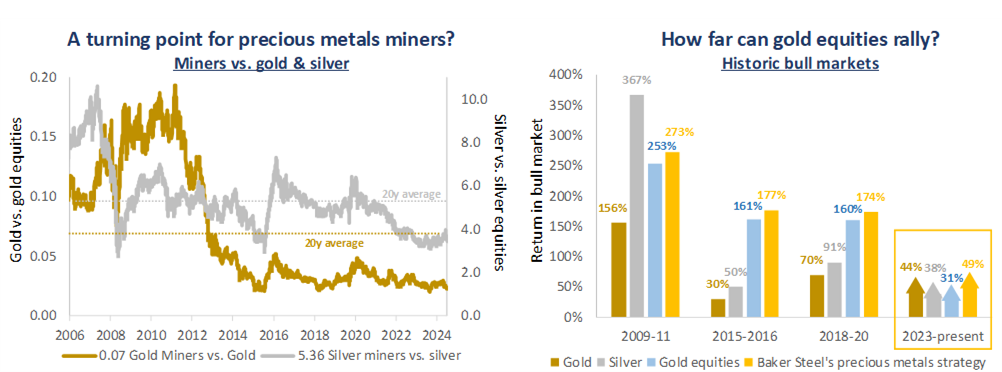

Turning to the precious metals miners, the sector lagged both gold and silver in 2024, yet based on previous bull markets we expect gold miners to deliver significantly higher returns over the course of the upcycle. At this point in the cycle, margin expansion is a key driver for precious metals equities. With the average all-in sustaining cost (“AISC”) of producing an ounce of gold at around USD 1500/oz, and the gold price today at over USD 2600/oz, the sector’s profitability is strong[xix]. Costs are rising, yet the pace of inflation has slowed significantly over the past two years. Certain costs, such as state royalties, are unavoidable yet overall cost control has been managed well, aided by technology and a persistent focus on capital discipline.

Figure 7

Sources: Bloomberg, Baker Steel Capital Managers LLP. Data at 31 December 2024. Note, gold equities based on XAU Index.

We consider that miners are in strong financial and operational shape, and recent meetings and site visits by Baker Steel’s team has reinforced our view that the sector is poised for re-rating. Alongside offering compelling value and shareholder returns, the sector is seeing selective M&A deals. Recent months have seen multiple deals, from Gold Fields acquisition of Osisko Mining in a deal worth USD 1.6b in August 2024, to First Majestic Silver’s acquisition of Gatos Silver for USD 970m, AngloGold Ashanti’s purchase of Centamin for USD 2.5b and Coeur Mining’s acquisition of SilverCrest Metals for USD 1.7b in September 2024. In our view these deals have largely proved constructive. Quality assets with low-cost profiles are rare, and geopolitical risk remains a key concern. Regarding exploration and development, we see that exploration budgets are clearly increasing. Yet while there have been some excellent recent discoveries, these require years of permitting and funding. Most of the large capital projects have already been undertaken by the companies, and we see few excellent projects on the horizon.

Amid strong macroeconomic tailwinds for precious metals, pro-growth policies in the US, and with precious metals miners largely in healthy financial shape, 2025 offers substantial opportunity for investors. In previous cycles, the combination of expanding margins for miners and resurgent investor interest in gold has boosted precious metals miners. With these factors in place, the stage is set for gold equities to deliver substantial outperformance of physical gold in the next phase of the bull market, in an environment we believe will be ripe for stock pickers to thrive.

What’s next for the metals and mining sector?

We believe mining equities have an important role to play in an investor’s portfolio in 2025. Mining is an undervalued equity sector, backed by strong demand and supply dynamics, which exhibits a relatively low correlation to US equity markets, making the sector a valuable diversifier at a time of lofty valuations in US markets, particularly technology. From geopolitics and economic policy to supply and demand dynamics, the year ahead holds substantial promise for the metals and mining sector, particularly for the precious metals sector and for metals closely associated with the new industrial revolution. Investors will need to balance short-term volatility with long-term opportunities tied to structural shifts in global economies and industries, yet amid a range of near-term catalysts we consider that the upside potential is significant for this undervalued sector.

The mining sector in 2025 is set for growth, driven by rising demand for critical metals required for the new industrial revolution, alongside macroeconomic trends and supportive market conditions for precious metals. Looking at the year ahead we favour commodities with strong production discipline and demand recovery potential, such as aluminium, copper, gold, silver, rare-earth elements, tin and uranium. Regarding mining equities, we focus on companies with earnings growth and healthy balance sheets, which we believe will drive relative performance. New technologies, supply chains challenges, sustainability goals and other factors all drive the need for bottom-up stock research and engagement. Baker Steel’s investment strategies are positioned to capitalise on the wide range of opportunities across the metals and mining sector and we believe market conditions are conducive for our active investment style.

[i] IEA, CRU, Wood Mackenzie, Benchmark Mineral Intelligence, Bloomberg, BNEF, Baker Steel Capital Managers LLP.

[ii] WoodMackenzie, RBC, Baker Steel internal research

[iii] Bloomberg. Data at 31 December 2024.

[iv] IEA. *Announced Pledges Scenario (APS) and Net Zero Emissions by 2050 Scenario (NZE).

[v] BNEF.

[vi] Goldman Sachs.

[vii] Bitcoin Energy Consumption Index.

[viii] Bloomberg.

[ix] FT Future of the Car 2022 conference.

[x] PRC Macro.

[xi] Bank of America.

[xii] World Gold Council, Q3 2024 Demand Trends.

[xiii] Committee for a Responsible Federal Budget.

[xiv] Bloomberg, data at 31 October 2024.

[xv] Bloomberg. Data at 30 September 2024.

[xvi] Silver Institute, Baker Steel internal.

[xvii] Samsung, WhichEV.

[xviii] World Platinum Investment Council

[xix] World Gold Council, Metals Focus. AISC data as at 31 March 2024.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.